Introduction

In the complex fabric of the digital landscape, Bitcoin hashrate stands as a crucial element, intertwining the domains of technology, economics, and pioneering thought. As we navigate the junctures of a decentralized horizon, grasping the intricacies of this revolutionary metric becomes essential. Mining, traditionally associated with the quest for tangible riches, has taken on a new meaning in the cryptocurrency era. It’s not merely about the allure of gold and pickaxes; it’s centered on the might of computational prowess and the enigmas of cryptographic challenges.

Delving deeper into the mechanics of Bitcoin mining, two terms frequently surface: hashrate and hashprice. The former, a testament to the network’s security and computational prowess, has been on a meteoric rise, echoing Bitcoin’s own journey from obscurity to mainstream acceptance. Yet, as with any tale of growth, there are complexities. The hashprice, which should ideally mirror the hashrate’s ascent, presents a contrasting narrative. This divergence between the soaring hashrate and the relatively stagnant hashprice is more than just a statistical anomaly; it’s a reflection of the market’s sentiments, external influences, and the ever-evolving dynamics of supply and demand. As we navigate the Bitcoin ecosystem, understanding this disparity becomes crucial, not just for miners but for every stakeholder in the decentralized ledger of blockchain.

The Rise and Implications of Bitcoin Hashrate

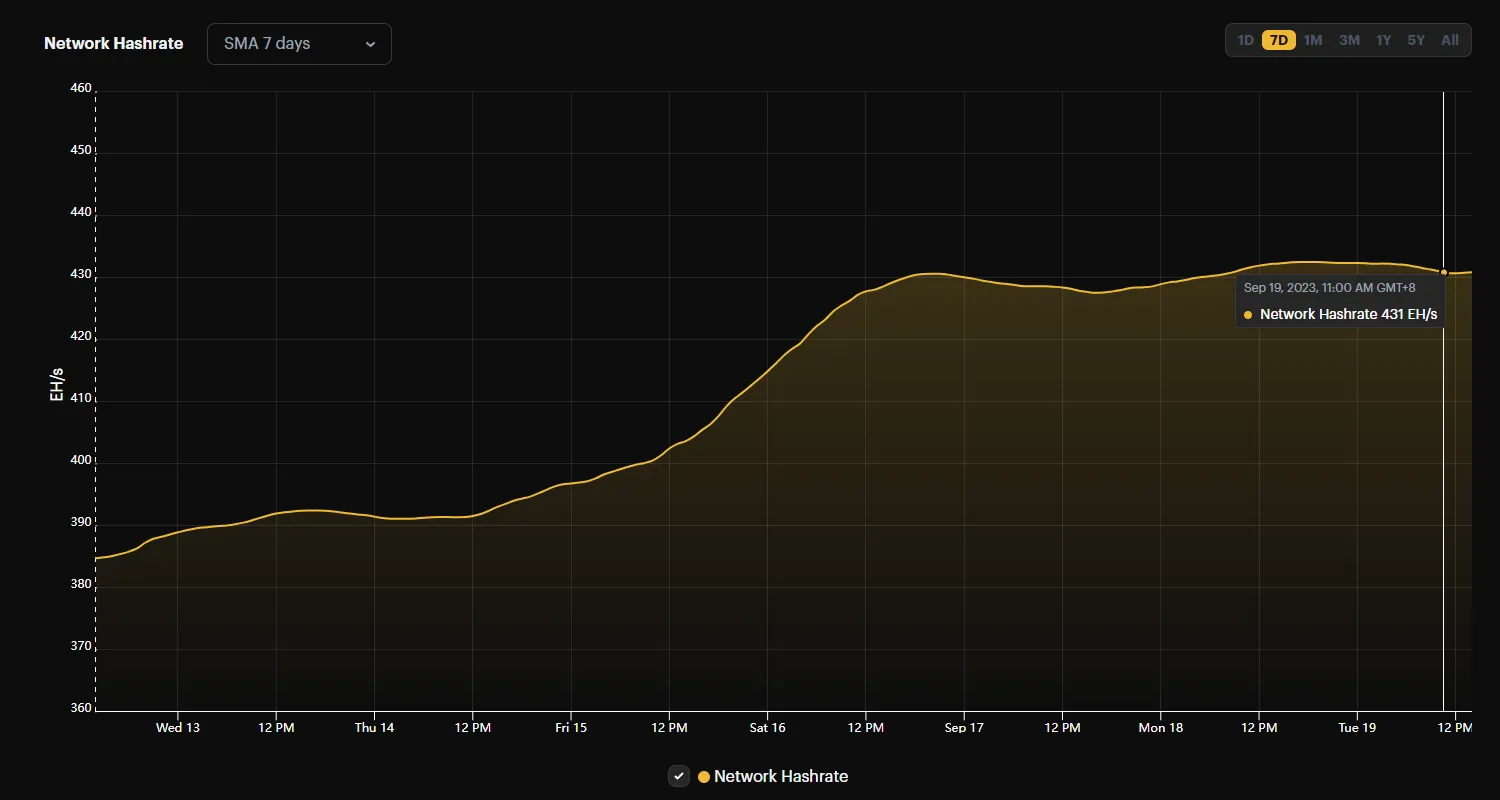

In the cryptographic tapestry of Bitcoin, the hashrate stands as a sentinel of security and a barometer of the network’s vitality. Recent oscillations in this metric provide a window into the evolving landscape of Bitcoin mining. A rising hashrate is emblematic of a fortified network, where miners, in increasing numbers, commit computational resources to validate and chronicle transactions on the blockchain. This ascendancy is not merely a reflection of technological prowess but also a testament to the burgeoning confidence in Bitcoin’s decentralized promise.

Nature’s Hand in the Digital Gold Rush

Beyond the silicon and code that underpin Bitcoin mining lies an often-overlooked protagonist: Mother Nature. The capriciousness of weather patterns, particularly in mining hotspots like Texas, plays a pivotal role in shaping the hashrate narrative. As the mercury dips, ushering in cooler climes, the energy-intensive process of mining becomes more feasible. Mega-miners, once shackled by the sweltering heat, now find themselves unbridled, contributing to the hashrate’s upward trajectory. This interplay between natural phenomena and digital endeavors underscores the symbiotic relationship between the physical and virtual realms.

The Halving Horizon: Preparing for a Paradigm Shift

On the horizon of Bitcoin’s timeline looms a moment of profound significance: the halving event of April 2024. This preordained recalibration, which will see the rewards for mining Bitcoin halve, is more than a mere algorithmic adjustment. It’s a watershed moment that will challenge the tenacity of miners and potentially recalibrate the equilibrium between hashrate and hashprice. As the clock ticks down to this event, the global mining community is abuzz with preparations, strategizing to navigate the impending shift in economic dynamics and to ensure the continued sanctity and security of the Bitcoin ledger.

Hashprice: A Closer Look

In the vast, cryptographic expanse of Bitcoin, the hashprice emerges as a nuanced metric, reflecting the economic underpinnings of the mining process. Over the past month, a meticulous analysis of this metric reveals a tale of contrasts. While the hashrate—symbolic of the network’s computational vigor—has been on an upward trajectory, the hashprice has charted a more tempered course. This metric, which quantifies the reward a miner receives for each unit of hashrate they contribute, offers insights into the delicate balance of supply and demand, technological advancements, and market sentiment. Its performance over the past month, juxtaposed against the rising hashrate, paints a picture of a market in flux, grappling with the intricacies of a decentralized economy.

Forecasting the Hashprice Horizon

Peering into the crystal ball of Bitcoin’s future, the implications of the current hashprice trends are manifold. As the hashrate continues its ascent, propelled by technological innovations and increased mining activity, one might anticipate a commensurate rise in hashprice. However, the intricacies of the Bitcoin protocol, external market forces, and the looming halving event introduce variables that challenge this linear projection. The rising hashrate, while indicative of a robust network, could lead to increased competition among miners, potentially exerting downward pressure on the hashprice. Furthermore, externalities such as regulatory shifts, energy costs, and macroeconomic factors will undoubtedly shape the hashprice narrative in the months and years to come.

The Mining Market: A Snapshot

In the intricate machinery of Bitcoin mining, transaction fees emerge as a pivotal cog, influencing the economic calculus for miners. Recent data points to an uptick in these fees, a trend that carries multifaceted implications. At a granular level, transaction fees are rewards miners receive for validating and adding transactions to the blockchain. Their increase signifies a bustling network, with heightened transactional activity. For miners, this surge augments their rewards, especially in times when block rewards might seem less lucrative. However, this rising tide also hints at network congestion, potentially leading to longer transaction times. In the delicate balance of profitability and network health, these escalating fees become a double-edged sword, offering both opportunities and challenges for the mining community.

Beyond Fees: Delving into the Network’s Pulse

To truly grasp the state of the Bitcoin mining market, one must venture beyond transaction fees and immerse oneself in the broader network data. The mining difficulty, a dynamic metric, adjusts to ensure that the time taken to mine a block remains consistent, irrespective of the total computational power of the network. Its fluctuations provide insights into the competitive landscape of mining. Then there’s the realm of mining rewards, a direct incentive for miners, which will undergo a seismic shift with the upcoming halving event. Lastly, the ASIC prices, indicative of the cost of entry and sustenance in the mining arena, offer a window into the technological advancements and market demand for mining hardware.

Top Mining News Highlights

In the ever-evolving realm of Bitcoin mining, a week can be a microcosm of transformative events, innovations, and shifts. The past seven days have been no exception, with headlines that not only chronicle the present but also hint at the future trajectory of the mining world. From F2Pool’s unexpected return of 19.8 BTC to Paxos due to an overpaid fee, signaling the inherent integrity within certain mining communities, to Blockstream’s unveiling of a new investment vehicle, showcasing the increasing financial instruments being built around mining activities. These headlines, while diverse, collectively sketch a narrative of a sector that’s both dynamic and maturing.

Implications and Ripples in the Mining Ecosystem

Beyond the immediacy of the headlines lies a deeper layer of implications for the broader mining community. The return of significant BTC amounts by mining pools, for instance, underscores the ethos of transparency and trust that’s foundational to the decentralized vision of Bitcoin. Such actions, while seemingly isolated, can bolster confidence among individual miners and institutional players alike. On the other hand, the advent of new investment vehicles around mining activities indicates a growing financialization of the mining sector, potentially attracting a new cohort of investors and stakeholders. Each news item, in its essence, is a thread weaving the intricate fabric of the mining ecosystem, with implications that could shape strategies, investments, and the very ethos of the community.

Modern Mining Machines: A Review

In the digital gold rush that is Bitcoin mining, the pickaxe and shovel have been replaced by sophisticated machines, engineered for precision, efficiency, and unparalleled computational prowess. As we stand on the cusp of a new era in decentralized mining, it’s imperative to acquaint ourselves with the vanguard of this technological evolution. These modern machines, with their intricate designs and advanced capabilities, are not just tools; they are the very heartbeats of the Bitcoin network, ensuring its security, vitality, and continuity.

Spotlight on Miners1688: Pioneers in Mining Excellence

Diving into the offerings of Miners1688, a name that resonates with quality and innovation in the mining community, we encounter a trio of series that stand out:

- ICERIVER KAS Miner Series:A testament to cutting-edge design and efficiency, the ICERIVER series boasts a range of models, each tailored to cater to varying mining needs. From the robust KS3M to the versatile KS0 with its integrated PSU, ICERIVER exemplifies the fusion of power and precision.

- Bitmain Antminer Series:A stalwart in the mining arena, Bitmain’s Antminer series has been a trusted companion for miners globally. With models like the S19k Pro and the S19 Pro Hyd., Bitmain continues its legacy of delivering machines that balance performance with energy efficiency.

- MicroBT Whatsminer Series:Carving a niche for itself with its impeccable performance metrics, the Whatsminer series from MicroBT is a force to reckon with. Models like the M30S++ and the M56S++ are not just machines; they are statements of MicroBT’s commitment to pushing the boundaries of mining technology.

In the grand tapestry of Bitcoin mining, these machines from Miners1688 are more than mere cogs; they are catalysts propelling the network forward. Their benefits extend beyond raw computational power. Enhanced energy efficiency ensures a greener mining footprint, while advanced cooling systems promise longevity and sustained performance. Furthermore, their modular designs allow for scalability, a crucial feature in the ever-evolving mining landscape. In essence, these machines, with their myriad features, are emblematic of the future of decentralized mining—a future that promises growth, sustainability, and unparalleled security.

Stock Performance in the Mining Sector

In the grand theater of financial markets, Bitcoin mining stocks have emerged as both protagonists and enigmas. Over the past week, these stocks have danced to a rhythm that’s both reflective of the broader market sentiment and specific to the nuances of the mining sector. Some have soared, riding the wave of optimism and technological advancements, while others have faced the brunt of externalities, from regulatory shifts to energy price volatilities. This ebb and flow, while seemingly chaotic, offers a window into the health, potential, and challenges of the Bitcoin mining industry.

Gleaning the Future from the Financial Foothills

Stock movements, especially in a sector as dynamic as Bitcoin mining, are more than just numerical fluctuations; they are harbingers. The recent performance of mining stocks might hint at several underlying narratives. A surge could indicate increased institutional interest, technological breakthroughs in mining hardware, or even favorable regulatory winds. Conversely, a dip might signal market apprehensions about upcoming protocol changes (like the halving), geopolitical tensions, or energy concerns. For the discerning observer, these stock trajectories provide valuable insights, not just about the present state but also about the future contours of Bitcoin mining. They serve as a barometer, gauging the market’s confidence, apprehensions, and aspirations related to the decentralized promise of Bitcoin.

Conclusion

As we stand at the confluence of technology, economics, and human endeavor, the realm of Bitcoin mining presents itself as a microcosm of innovation and challenges. The hashrate, with its upward trajectory, stands testament to the network’s resilience and the miners’ unwavering commitment. Yet, the contrasting dance of the hashprice, not always in tandem with the hashrate, offers a nuanced tale of market dynamics, external influences, and the ever-evolving balance of supply and demand. Complementing this narrative is the advent of modern mining machines, technological marvels that are pushing the boundaries of efficiency, power, and profitability.

Peering into the Crypto Crystal Ball

As we cast our gaze forward, the landscape of Bitcoin mining is poised for both transformation and turbulence. The upcoming halving event, a seminal moment in Bitcoin’s timeline, will challenge the mettle of miners, potentially reshaping the equilibrium between profitability and network security. For potential miners and investors, the recommendation is one of prudence, education, and adaptability. Embrace the technological advancements, stay abreast of regulatory shifts, and always be prepared to pivot strategies in response to the market’s capricious nature. The world of cryptocurrency, with its promise of decentralization and empowerment, beckons. Yet, like any frontier, it demands both courage and caution.