Introduction

In the intricate tapestry of the cryptocurrency mining industry, the hashrate of Bitcoin stands as a pivotal thread, weaving together the narratives of technological prowess, economic viability, and network security. As of November 27, 2023, this metric not only serves as a barometer for the health and efficiency of Bitcoin mining but also as a beacon guiding the ever-evolving landscape of digital currency.

The current state of Bitcoin’s hashrate, as reflected in the comprehensive data from Hashrate Index, paints a picture of a robust and dynamic network. With a network hashrate averaging around 489.44 EH/s over the last seven days, the Bitcoin network continues to demonstrate remarkable resilience and strength. This figure is not just a number; it represents the cumulative computational power contributed by miners worldwide, each vying for the rewards of solving the cryptographic puzzles that underpin the blockchain.

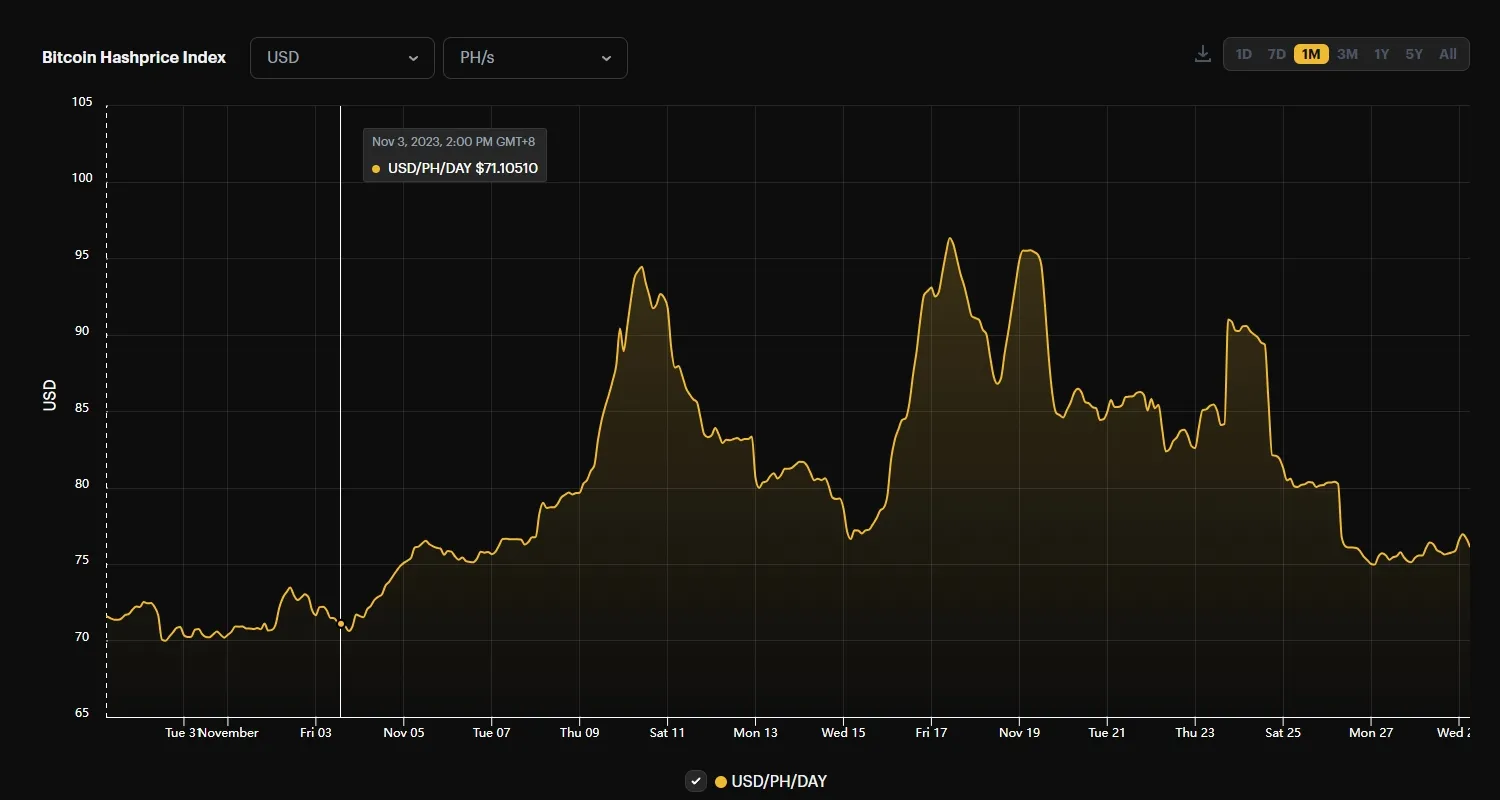

In this ever-competitive arena, the hashrate is more than a mere statistic; it is the lifeblood of Bitcoin mining. It signifies the relentless pursuit of efficiency, as miners deploy increasingly sophisticated hardware to gain an edge. The hashrate’s ebb and flow are a dance of supply and demand, influenced by factors such as Bitcoin’s market price, currently standing at $37,190, and the network difficulty, which is at a formidable 67.96 T.

As we delve deeper into the nuances of Bitcoin’s hashrate, we must appreciate its multifaceted role. It is a guardian of network security, deterring malicious actors through sheer computational might. It is a measure of participation, reflecting the global and decentralized nature of Bitcoin mining. And, perhaps most importantly, it is a harbinger of the future, signaling the potential directions and innovations in this ever-evolving digital odyssey.

In this introduction, we set the stage to explore the depths and breadths of Bitcoin’s hashrate as of November 27, 2023. We will navigate through its implications, challenges, and the opportunities it presents, offering a comprehensive understanding of this critical aspect of the Bitcoin ecosystem.

Understanding Bitcoin’s Hashrate

The Essence of Hashrate in Bitcoin Mining

In the realm of Bitcoin, the term ‘hashrate’ emerges as a fundamental concept, pivotal to the understanding of its mining process. At its core, the hashrate epitomizes the computational power employed by miners to validate transactions and secure the Bitcoin network. It is measured in exahashes per second (EH/s), a testament to the immense processing power at play.

The significance of the hashrate extends beyond mere numbers; it is the heartbeat of the Bitcoin blockchain. A higher hashrate signifies greater security, making the network more resilient against potential attacks. It is a measure of health, indicating the level of miner participation and, by extension, their collective confidence in the Bitcoin ecosystem. In essence, the hashrate is a mirror reflecting the robustness and vitality of Bitcoin mining.

Tracing the Evolution of Bitcoin’s Hashrate

The historical trajectory of Bitcoin’s hashrate is a narrative of exponential growth and technological evolution. In the early days of Bitcoin, the hashrate was modest, with miners using basic CPUs and GPUs. As the value and popularity of Bitcoin grew, so did the hashrate, marking a shift towards more specialized and powerful mining hardware like ASICs (Application-Specific Integrated Circuits).

Data from Hashrate Index reveals a fascinating journey of Bitcoin’s hashrate over the years. From humble beginnings, the network hashrate has soared to staggering heights, reaching around 488.81 EH/s as of late November 2023. This growth is not just a function of rising Bitcoin prices but also a testament to the advancements in mining technology and the increasing global interest in Bitcoin mining.

The evolution of the hashrate is also a story of the mining community’s adaptability and innovation. As the network’s difficulty adjusts to maintain a 10-minute block time, miners have continually sought more efficient ways to contribute to the network’s security. This relentless pursuit of efficiency is a hallmark of Bitcoin’s decentralized nature, where no single entity controls the network, but a collective of miners ensures its integrity and continuity.

Current State of Bitcoin’s Hashrate

Analyzing the Present: Bitcoin’s Hashrate as of November 27, 2023

As we stand at the cusp of the year 2023, the Bitcoin network’s hashrate presents a remarkable picture of resilience and growth. The current hashrate, averaging around 488.81 EH/s over the past week, is not just a number but a testament to the unwavering commitment of miners across the globe. This figure represents an aggregation of immense computational efforts, each contributing to the fortification of the Bitcoin network.

The significance of this hashrate extends beyond mere computational power; it is a reflection of the network’s health and efficiency. A high hashrate indicates a robust network, less susceptible to attacks and more capable of handling large transaction volumes. It is a beacon of security in the digital currency landscape, assuring investors and users of the network’s integrity.

Historical Context: The Evolution of Bitcoin’s Hashrate

To fully appreciate the current state of Bitcoin’s hashrate, one must look back at its historical trajectory. Over the years, the hashrate has seen exponential growth, mirroring the rising interest and investment in Bitcoin mining. From the early days of mining with basic CPUs to the current era of specialized ASICs, the hashrate has been a barometer of technological advancement and miner engagement.

Comparing the current hashrate with previous years, we observe a consistent upward trend. This growth is not just a result of the increasing popularity of Bitcoin but also a reflection of the advancements in mining technology and efficiency. The journey from mere gigahashes to the current exahashes is a story of innovation, competition, and the relentless pursuit of mining efficiency.

Influential Factors: What Drives Bitcoin’s Hashrate?

Several key factors influence the level of Bitcoin’s hashrate. Firstly, the price of Bitcoin plays a crucial role. Higher prices incentivize more miners to join the network, thereby increasing the hashrate. Conversely, a drop in price can lead to a decrease in mining activity. Secondly, the cost and efficiency of mining hardware are significant. As miners seek more efficient and powerful rigs, the hashrate naturally increases.

Another critical factor is the mining difficulty, which adjusts to maintain a 10-minute average block time. As the difficulty increases, miners are compelled to boost their computational power, thereby elevating the hashrate. Additionally, external factors such as regulatory changes, electricity costs, and technological breakthroughs also play a role in shaping the hashrate landscape.

Impact of Hashrate Changes

The Ripple Effect on Miners and the Mining Industry

In the intricate world of Bitcoin mining, hashrate fluctuations are more than mere statistical changes; they are powerful currents that shape the fortunes of miners and the landscape of the mining industry. When the hashrate surges, it signals a robust participation, drawing more miners into the fray. This increased competition, while bolstering the network’s security, also tightens the margins for individual miners. Each miner’s share of the Bitcoin reward diminishes as more players enter the game, necessitating a constant upgrade in mining hardware and strategies to stay afloat.

Conversely, a decline in the hashrate can be a double-edged sword. It may indicate a reduction in competition, potentially increasing the profitability for those who remain. However, it can also signal underlying issues such as declining Bitcoin prices or increased operational costs, leading to a miner exodus. This ebb and flow in the hashrate are pivotal, dictating the operational dynamics and economic viability of the mining industry.

Interplay Between Hashrate, Mining Difficulty, and Bitcoin’s Price

The relationship between Bitcoin’s hashrate, mining difficulty, and its price is a complex yet fascinating dance of interdependent variables. The hashrate and mining difficulty are intrinsically linked; as more miners join the network and the hashrate increases, the network difficulty automatically adjusts upwards to maintain the ten-minute average block discovery time. This increased difficulty requires more computational power, leading to higher operational costs for miners.

Bitcoin’s price plays a crucial role in this equation. A higher Bitcoin price can offset the increased costs due to higher difficulty, keeping mining profitable and enticing more miners to join the network, further boosting the hashrate. Conversely, a drop in Bitcoin’s price can make mining less profitable, especially if the difficulty remains high, potentially leading to a decrease in the hashrate as miners with higher operational costs are forced to bow out.

Assessing the Future: Short-Term and Long-Term Implications

The current trends in Bitcoin’s hashrate carry significant implications for both the short-term and long-term horizons of the mining industry. In the short term, fluctuations in the hashrate can lead to immediate impacts on mining profitability, influencing miners’ operational decisions. It can also affect the network’s transaction processing capacity and fee market, as changes in mining power can lead to variations in block discovery times.

In the long term, the trends in the hashrate are indicative of the health and sustainability of the Bitcoin network. A consistently high and growing hashrate suggests a robust and secure network, attracting more investment and development in the mining sector. It also reflects the confidence of miners in the future of Bitcoin, encouraging innovation in mining technology and practices. However, sustained periods of low profitability due to high difficulty and low Bitcoin prices could lead to centralization risks, as only large-scale miners with economies of scale can survive, potentially challenging the decentralized ethos of Bitcoin.

Technological Advancements and Their Effects

The Evolution of Bitcoin Mining Technology

The landscape of Bitcoin mining has been continuously reshaped by the relentless march of technological innovation. From the early days of using simple CPUs to the current era dominated by ASIC (Application-Specific Integrated Circuit) miners, each leap in technology has brought about a paradigm shift in mining efficiency and effectiveness. These advancements are not mere incremental improvements; they represent revolutionary changes that redefine the boundaries of what is possible in Bitcoin mining.

The introduction of ASIC miners was a game-changer, offering unprecedented hashing power with significantly lower energy consumption compared to their predecessors. This evolution has been marked by a constant race among manufacturers to develop more powerful and energy-efficient models, leading to a rapid escalation in the network’s total hashrate. The modern ASICs are marvels of engineering, optimized specifically for mining Bitcoin, and are a far cry from the general-purpose hardware used in the early days.

Impact on the Hashrate

The advancements in mining technology have a direct and profound impact on Bitcoin’s hashrate. As newer, more efficient miners are deployed, the total computational power of the network increases, leading to a rise in the hashrate. This increase is not merely a function of more miners joining the network; it is also a result of existing miners upgrading their equipment to stay competitive.

The introduction of more efficient mining rigs means that more hashes can be computed per second for the same or even lower energy consumption. This efficiency gain is crucial, especially in an environment where energy costs can significantly impact mining profitability. As miners continue to seek out the latest technology to maximize their returns, the network’s hashrate is expected to continue its upward trajectory.

Looking Ahead: Future Technological Developments

The future of Bitcoin mining technology holds immense potential, with several developments on the horizon that could further revolutionize the industry. One area of focus is the continued improvement in ASIC efficiency, reducing the energy footprint per hash, which is vital for both profitability and environmental sustainability. Additionally, there is growing interest in harnessing renewable energy sources for mining operations, aligning the industry with broader global energy and environmental goals.

Another exciting prospect is the potential development of new mining algorithms and hardware that could further optimize the mining process or even democratize it, making it more accessible to a broader range of participants. This could lead to a more decentralized mining landscape, reinforcing the foundational principles of Bitcoin.

Bitcoin Mining Market Dynamics

The ASIC Miner Market: A Catalyst for Hashrate Growth

In the intricate ecosystem of Bitcoin mining, ASIC (Application-Specific Integrated Circuit) miners have emerged as the linchpin, profoundly influencing the network’s hashrate. These specialized devices, engineered exclusively for mining Bitcoin, have replaced less efficient methods, heralding a new era of heightened computational power and efficiency. The ASIC miner market is not just a marketplace for hardware; it is the battleground where the arms race of hashrate escalation unfolds.

The dominance of ASIC miners has led to a surge in the network’s hashrate, as these machines are exponentially more powerful than their predecessors. This surge is a double-edged sword; while it enhances network security and efficiency, it also raises the entry barrier for new miners, potentially centralizing mining power in the hands of those who can afford these advanced machines. The market dynamics of ASIC miners, including their availability, cost, and performance, play a pivotal role in shaping the overall hashrate of the Bitcoin network.

Transaction Fees and Hashrate: An Interconnected Dance

Transaction fees in the Bitcoin network, though often overshadowed by block rewards, play a significant role in the mining ecosystem, especially as the block reward continues to halve approximately every four years. These fees, paid by users to have their transactions included in the blockchain, become a more critical source of revenue for miners over time.

There exists a nuanced interplay between transaction fees and the hashrate. When the network’s hashrate increases, it often leads to faster block discovery times until the next difficulty adjustment. This can temporarily lead to a decrease in transaction fees as more transactions are processed in a shorter time. Conversely, a lower hashrate can lead to slower block times and a potential increase in transaction fees due to a backlog of transactions. Understanding this relationship is crucial for miners, as it directly impacts their profitability and operational strategies.

Generational Shifts in Mining Rigs: Market Appetite and Trends

The Bitcoin mining hardware market is characterized by a continuous generational shift, with each new wave of ASIC miners bringing enhanced efficiency and power. The market appetite for different generations of mining rigs is a dynamic indicator of the industry’s health and direction. Older generations of ASICs, while less efficient, remain relevant in regions with lower electricity costs, highlighting the geographical diversification in mining.

The demand for the latest generation of ASIC miners is a reflection of the industry’s relentless pursuit of efficiency and profitability. However, this demand is tempered by factors such as production limitations, cost, and the ever-present risk of market fluctuations in Bitcoin’s price. Miners must navigate these waters carefully, balancing the desire for the latest technology with the practicalities of return on investment and operational sustainability.

Industry News and Developments

The Latest in Bitcoin Mining: A 2023 Snapshot

As we navigate through the final quarter of 2023, the Bitcoin mining sector continues to evolve, marked by significant developments that shape its landscape. These developments, ranging from regulatory shifts to technological breakthroughs, not only influence the operational aspects of mining but also have a profound impact on the network’s hashrate.

One of the key highlights of the year has been the introduction of next-generation ASIC miners, boasting unprecedented efficiency and computational power. This leap in technology has sparked a renewed interest in mining, attracting both seasoned players and new entrants to the field. Additionally, there’s been a noticeable trend towards sustainable mining practices, with an increasing number of operations transitioning to renewable energy sources. This shift not only addresses environmental concerns but also aims to reduce operational costs, making mining more economically viable in the long run.

Regulatory changes in various countries have also played a crucial role in shaping the industry. Some regions have embraced Bitcoin mining, offering incentives and clear regulatory frameworks, thereby attracting miners and boosting the local economy. In contrast, others have imposed restrictions or outright bans, citing concerns over energy consumption and financial stability. These regulatory landscapes significantly influence where mining operations are set up, affecting the global distribution of the hashrate.

Impact on the Hashrate: A Ripple Across the Network

The aforementioned developments in the Bitcoin mining sector have a direct and cascading effect on the network’s hashrate. The introduction of more efficient mining hardware typically leads to an increase in the hashrate, as miners are able to process more transactions with greater efficiency. This not only enhances the security of the Bitcoin network but also increases its capacity to handle a larger volume of transactions.

The shift towards renewable energy sources is also a critical factor in sustaining the hashrate growth. By reducing the reliance on traditional, more expensive energy sources, miners can maintain profitability even during periods of lower Bitcoin prices, ensuring continuous participation in the network. This is crucial for maintaining a stable and growing hashrate, which is essential for the health and security of the Bitcoin blockchain.

Regulatory changes, on the other hand, can have a mixed impact on the hashrate. Positive regulatory environments can lead to a surge in mining activities, thereby boosting the hashrate. Conversely, restrictive policies in certain regions can lead to a redistribution of mining power, as miners relocate to more favorable jurisdictions. This geographical shift in mining activities can lead to temporary fluctuations in the hashrate but often stabilizes as miners adapt to the new landscape.

Bitcoin Mining Stocks and Financial Perspective

The Interplay Between Mining Stocks and Hashrate

In the financial tapestry of Bitcoin mining, the stocks of mining companies serve as a crucial indicator, reflecting the sector’s health and prospects. These stocks are inextricably linked to the hashrate, a key metric of the Bitcoin network’s strength and efficiency. As the hashrate climbs, it often signals enhanced network security and miner commitment, factors that can bolster investor confidence in mining stocks.

The relationship between mining stocks and the hashrate is nuanced and multifaceted. A rising hashrate, driven by technological advancements and increased mining activity, can lead to heightened expectations of future profitability, potentially boosting stock prices. Conversely, a declining hashrate, possibly due to adverse market conditions or regulatory challenges, can dampen investor sentiment, reflecting in the stock performance.

This dynamic is further influenced by Bitcoin’s price fluctuations. As the price of Bitcoin rises, the potential revenue for miners increases, often leading to a surge in mining stocks. However, this correlation is not always straightforward, as the stocks are also subject to broader market sentiments and individual company performances.

Financial Performance of Key Mining Companies

The financial health of key players in the Bitcoin mining industry offers valuable insights into the sector’s overall status. In 2023, several leading mining companies have reported robust financial performances, buoyed by the sustained high hashrate and favorable Bitcoin prices. These companies have benefited from strategic investments in efficient mining equipment, cost-effective energy solutions, and operational scalability.

However, the financial landscape is not uniform across the board. Some companies have faced challenges due to factors such as rising energy costs, regulatory hurdles, or logistical issues. These challenges highlight the importance of efficient operations and adaptability in an industry characterized by rapid technological advancements and fluctuating market conditions.

The financial performance of these companies is a critical component of the Bitcoin mining ecosystem. It not only affects investor sentiment and stock prices but also impacts the companies’ ability to reinvest in new technology and expand their operations. This, in turn, can influence the network’s hashrate and overall health.

Conclusion

As we reflect on the multifaceted landscape of Bitcoin mining as of November 27, 2023, several key themes emerge, each contributing to the rich tapestry of this dynamic industry. The hashrate of Bitcoin, a critical measure of the network’s computational power and security, stands at the heart of these discussions, serving as a barometer for the health and vitality of the cryptocurrency.

The journey through the various facets of Bitcoin mining reveals a complex interplay of technology, market dynamics, and financial considerations. The evolution of mining technology, particularly the advent and dominance of ASIC miners, has dramatically influenced the hashrate, pushing it to unprecedented heights. This technological progression underscores a relentless pursuit of efficiency and profitability in the mining sector.

The fluctuations in the hashrate, influenced by factors such as Bitcoin’s price, mining difficulty, and the global distribution of mining power, have significant implications for miners and the broader Bitcoin ecosystem. These changes affect not only the immediate profitability of mining operations but also the long-term sustainability and security of the Bitcoin network.

Moreover, the financial perspective, particularly the performance of Bitcoin mining stocks, offers insights into the economic underpinnings of the industry. The financial health of key mining companies is a reflection of the sector’s overall status, influenced by the hashrate, Bitcoin’s market price, and broader economic factors.

As of November 27, 2023, the state of Bitcoin’s hashrate is not just a technical statistic; it is a narrative of innovation, adaptation, and resilience. It reflects the collective efforts of miners around the globe, the advancements in mining technology, and the ever-changing dynamics of the cryptocurrency market. The hashrate is a testament to the robustness of the Bitcoin network, assuring users and investors of its security and reliability.