Introduction

Bitcoin’s hashrate, as of November 7, 2023, stands as a testament to the enduring strength and escalating power of the network. This metric, often glossed over in mainstream discourse, is the very cornerstone of Bitcoin’s architecture, a quantifiable measure of the network’s pulse. To the uninitiated, the hashrate may seem an arcane term, yet it is the lifeblood of Bitcoin’s existence, the silent sentinel that guards the integrity of every transaction.

The significance of Bitcoin’s hashrate cannot be overstated. It is the cumulative horsepower of miners across the globe, each contributing their computational prowess to the network. As they race to solve complex cryptographic puzzles, they fortify the blockchain against the onslaught of potential security breaches. The hashrate is the shield against the double-spending problem, ensuring that Bitcoin remains a single source of truth in the digital realm.

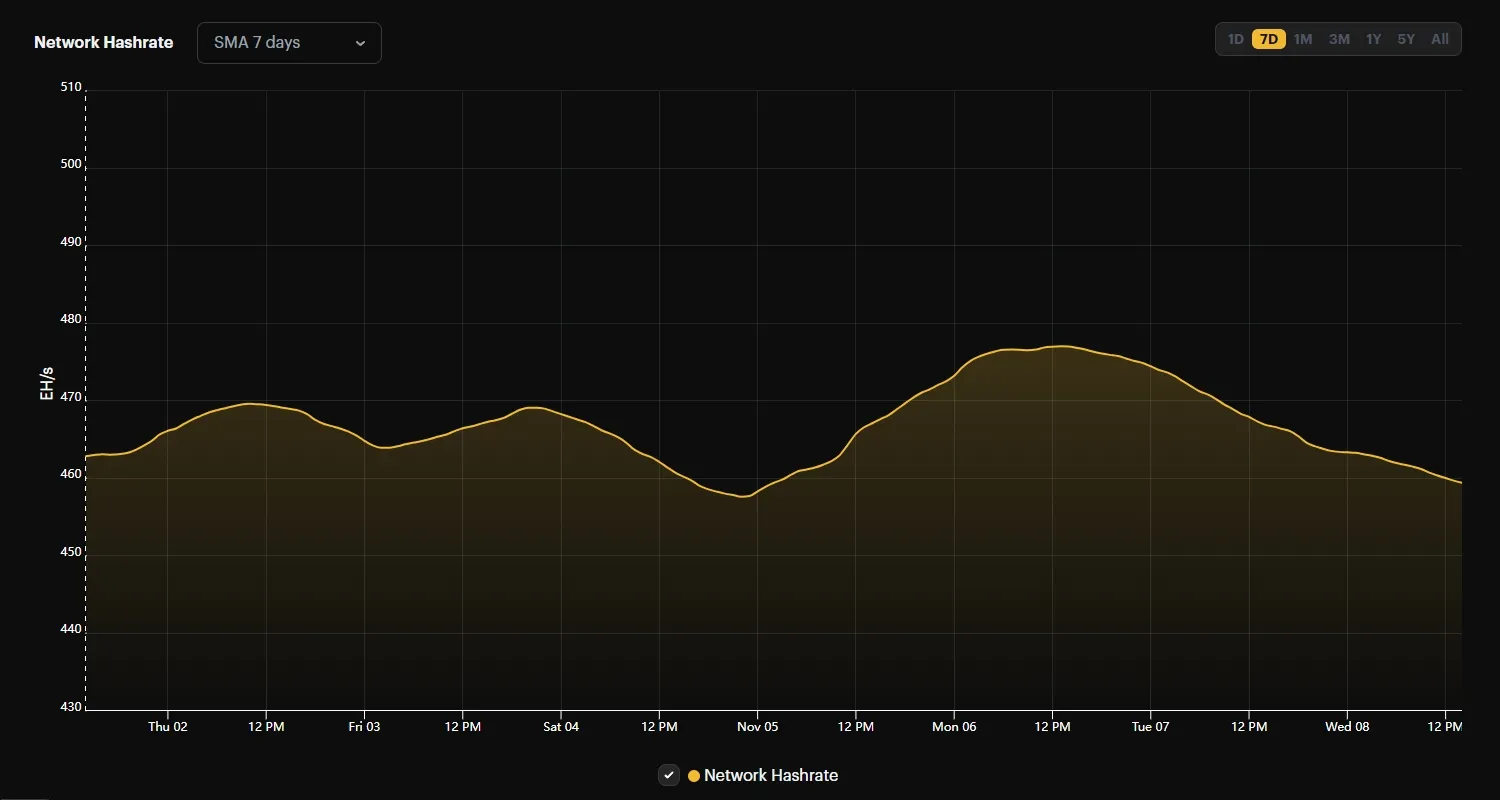

In the current landscape, the hashrate index reveals a network in the throes of growth, with the figures from the Hashrate Index chart showing a steady climb. This growth is not merely a function of more powerful hardware entering the fray but also a marker of the network’s increasing security. As the hashrate scales new heights, it becomes increasingly impractical for malicious actors to mount an attack, thereby reinforcing the trust in Bitcoin’s infrastructure.

The importance of the hashrate extends to the very health of the Bitcoin network. A robust hashrate signals a healthy network, bustling with activity and secured by the collective effort of miners. It is the drumbeat to which the entire system syncs, a rhythm that grows steadier and more resilient with each passing day. As we explore the nuances of Bitcoin’s hashrate, we delve into the heart of what makes Bitcoin a beacon of decentralization and a bulwark against central points of failure.

This introduction is but a prelude to the intricate dance of numbers and technology that the hashrate embodies. It is here, at the beginning of our discourse, that we lay the foundation for a deeper understanding of Bitcoin’s inner workings. As we peel back the layers, we will uncover the symbiotic relationship between the hashrate and the network’s health, and how together, they weave a tapestry of security and stability that is unparalleled in the digital age.

Historical Analysis of Bitcoin’s Hashrate

Tracing the lineage of Bitcoin’s hashrate is akin to mapping the growth rings of a digital sequoia. Each ring, each epoch of growth, tells a story of resilience and expansion. The current hashrate, as we observe it on November 7, 2023, is not just a figure in isolation. It is the latest crest on a wave that has been swelling since the inception of Bitcoin. Historical data from the Hashrate Index charts show us a trajectory that is both volatile and upward, a testament to the network’s increasing computational power. This power is the sum total of countless mining operations, each vying to solve the cryptographic puzzles that secure the network and mint new Bitcoin. The hashrate’s ascent over the years is a mirror reflecting the network’s burgeoning security and the miners’ growing investment in the future of cryptocurrency.

The Catalysts Behind the Surge

The recent surge in Bitcoin’s hashrate is not a phenomenon born out of the void. It is the confluence of technological advancement, economic incentive, and geopolitical shifts. The introduction of more efficient mining rigs, the allure of Bitcoin’s rising value, and the migration of mining operations following regulatory changes—each of these factors has woven into the fabric of the hashrate’s current zenith. The Hashrate Index provides a granular view of these shifts, particularly through the lens of the 7-day and 30-day simple moving averages (SMAs). These metrics smooth out the daily fluctuations to reveal the underlying trends, offering a clearer picture of the hashrate’s response to external stimuli.

Fluctuations and Their Ripple Effects

The undulations of Bitcoin’s hashrate are not without consequence. They ripple through the ecosystem, affecting everything from mining profitability to network security. When the hashrate dips, it can signal a withdrawal of mining power, potentially making the network more susceptible to attacks. Conversely, a high hashrate indicates a robust and secure network but also heralds increased competition among miners. This competition can lead to a rise in the difficulty of mining, squeezing the margins of less efficient operations. The historical data from the Hashrate Index charts these fluctuations, providing a window into the health of the mining industry and the security of the network at large.

Hashprice and Its Recent Developments

In the intricate ballet of Bitcoin mining, ‘hashprice’ emerges as the choreographer, guiding the profitability of the miners’ dance. It is the measure of the revenue a miner can expect to generate for every terahash of power expended on the network over a given time. This metric is the compass by which miners navigate the tumultuous seas of Bitcoin mining. It is their beacon when the waters are murky with volatility and their anchor in the quiet harbors of stability. Hashprice is the confluence where the technological prowess of mining meets the economic currents of the cryptocurrency market. Its relevance is paramount, for it directly influences the miners’ decision to either throttle their rigs’ power or to steer them full sail ahead.

The Surge in Hashprice: A Confluence of Factors

The recent uptick in hashprice is not merely a stroke of luck but the result of a confluence of deliberate factors. It is the windfall from the sails of Bitcoin’s price surge, the bounty from the network’s transaction fees, and the harvest from the halving events that cyclically tighten the supply of new Bitcoin. This increase is a harbinger of prosperity for the miners, a sign that their efforts are not only rewarded but are in increasing demand. The Hashrate Index charts this ascent with precision, capturing the nuances of the market and the miners’ response. As the hashprice climbs, it beckons new entrants and bolsters the resolve of the incumbents, each miner’s rig a testament to the lure of the Bitcoin bounty.

The Dance Between Bitcoin’s Price and Hashprice

The relationship between Bitcoin’s price and hashprice is a delicate dance, a pas de deux where each step is measured and each movement resonates with the other. When Bitcoin’s price pirouettes upwards, the hashprice often follows in tandem, as miners’ rewards are valued higher. Conversely, a dip in Bitcoin’s price can lead to a subdued hashprice, as the fruits of mining yield less in the market. This correlation is a tale of mutual influence, where the market’s sentiment towards Bitcoin’s value directly sways the profitability of mining operations. The Hashrate Index serves as the stage for this performance, charting the rhythm and flow of this intricate dance.

Mining Revenue and Network Growth

In the digital realm where Bitcoin reigns, mining revenue is the treasure sought by those who convert electricity into the currency of the cryptoverse. The current state of mining revenue is a complex mosaic, influenced by a myriad of drivers that extend beyond the mere discovery of new blocks. The price of Bitcoin, transaction fees, and the efficiency of mining hardware are the primary cartographers of this terrain. As Bitcoin’s valuation scales new summits, the spoils of mining become increasingly lucrative, enticing more participants to join the quest. Transaction fees, while smaller in comparison, are akin to the flakes of gold that accumulate to form a substantial trove over time. Meanwhile, advancements in mining technology continue to push the boundaries of what is possible, enabling miners to extract more from the network’s cryptographic bedrock with less energy. The Hashrate Index provides a lens through which we can observe the ebb and flow of these revenues, offering a real-time narrative of the mining economy’s health.

The Sustainability of Network Growth

As miners from all corners of the globe contribute their computational power to the network, we witness a growth that is both exhilarating and daunting. The sustainability of this expansion is a subject of much debate, akin to the philosophical musings on the limits of the universe. Can the network continue to grow at this pace, or will it encounter the natural checks and balances that govern all systems? The environmental impact of mining, the availability of resources, and the eventual approach of the network’s hard-coded supply limit all play crucial roles in this discourse. The network’s growth is not merely a function of hashrate but also of innovation in energy efficiency and the evolving landscape of global regulations. The Hashrate Index not only charts the growth but also serves as a harbinger of the network’s long-term viability.

Forecasting the Hashrate Horizon

Looking to the horizon, the impact of continued hashrate growth is a constellation of possibilities that miners and investors alike strive to chart. As the hashrate climbs, the difficulty of mining adjusts in tandem, ensuring the network’s heartbeat remains steady. This self-regulating mechanism is the genius of Bitcoin’s design, ensuring that no single miner or pool can monopolize the network’s treasures. However, with each increase in difficulty, the barriers to entry rise, potentially consolidating power among the most capitalized players. The Hashrate Index is the seer that tracks these shifts, offering a glimpse into the future of mining competition and network security. As we forecast the impact of hashrate growth, we must consider the delicate balance between decentralization and the inexorable march towards greater efficiency and consolidation.

Equipment and Technology Advances

In the arms race of Bitcoin mining, the introduction of the Antminer S21 marks a significant leap forward. This cutting-edge miner is not just a new entrant in the market; it is a herald of the future, a beacon of progress in the silicon mines of cryptocurrency. The Antminer S21 boasts an array of features that set it apart from its predecessors: unparalleled energy efficiency, a hash rate that dwarfs those that came before it, and a design that whispers the promise of longevity. The arrival of the S21 is a watershed moment, signaling a shift in the mining landscape where power and efficiency become the twin pillars of profitability. As miners around the globe set their sights on this new titan, the Hashrate Index serves as a testament to its impact, charting the shifts in the network’s power as these behemoths come online.

ASIC Advancements: The Wind Beneath Bitcoin’s Hashrate Wings

The role of Application-Specific Integrated Circuit (ASIC) advancements in the narrative of Bitcoin’s hashrate cannot be overstated. Each generation of ASICs brings with it a surge in hashrate, a testament to human ingenuity and the relentless pursuit of perfection. These machines are the engines of the Bitcoin network, each transistor, each chip, a cog in the vast machinery of the blockchain. As ASICs evolve, they become more adept at their singular purpose: to mine Bitcoin. This evolution is a key driver in the hashrate’s ascent, as each new model pushes the boundaries of what is possible. The Hashrate Index chronicles this ascent, capturing the steady climb of network power as a direct corollary to the advancements in ASIC technology.

Conclusion

As we stand at the precipice of the present, looking back on the terrain we’ve traversed, the journey through Bitcoin’s mining landscape reveals a narrative rich with complexity and achievement. We’ve witnessed the relentless climb of Bitcoin’s hashrate, a testament to the network’s robust health and the miners’ unwavering commitment. The introduction of groundbreaking equipment like the Antminer S21 has redefined the boundaries of mining efficiency, while the strategic timing of preorders has underscored the foresight of industry leaders. We’ve navigated the economic currents of ASIC pricing trends, felt the anticipatory pulse of the market ahead of the 2024 halving, and seen the visual stories told by key mining metrics.

Looking to the horizon, the outlook for Bitcoin’s hashrate and the mining industry is one of cautious optimism. The hashrate’s trajectory points towards a future where the network’s security is ironclad, and the mining industry’s foundations are robust. Yet, this future is not without its challenges. The environmental and economic hurdles that lie ahead will test the industry’s resilience, demanding innovation and adaptability. The halving of 2024 looms large, a milestone that will undoubtedly reshape the mining landscape once again. But the industry has shown time and again that it is capable of weathering the storms of change, emerging stronger with each challenge.

In our final thoughts, we must acknowledge the remarkable resilience and the bright future of Bitcoin mining. This industry, born of the digital age, has matured into a global economic force, one that is as influential as it is innovative. The miners, with their silicon picks and digital shovels, have not only carved out a new frontier but have also laid the foundations for a decentralized financial future. As we close this chapter, we do so with the knowledge that the industry’s resilience is not just found in the hashrate or the hardware but in the community’s spirit and the unwavering belief in the transformative power of Bitcoin mining.