Dogecoin has captured the imagination of cryptocurrency enthusiasts worldwide, sparking debates on whether it will hit the elusive $1 mark.

Dogecoin could potentially reach $1 by early 2025, driven by bullish trends, increased adoption, and market dynamics. Key factors include Bitcoin’s trajectory, social media influence, and investor sentiment.

While Dogecoin’s journey towards $1 seems promising, understanding the underlying factors and expert predictions is crucial for investors. In this blog, we delve into the nuances of market dynamics and the pivotal elements that could make or break Dogecoin’s path to $1.

What Role Does Bitcoin Play in Dogecoin‘s Price Movement?

Dogecoin’s price often mirrors Bitcoin’s movements, sparking curiosity about their connection. Let’s explore how Bitcoin influences Dogecoin and its potential impact on investors.

Bitcoin often serves as a market leader, influencing other cryptocurrencies like Dogecoin. Its price movements can set market trends, affecting investor sentiment and potentially driving Dogecoin’s price up or down.

Understanding Bitcoin’s Influence on Dogecoin

Bitcoin, the pioneer of cryptocurrencies, often acts as a bellwether for the entire market. When Bitcoin experiences significant price

movements, it usually results in a ripple effect throughout the crypto sphere.

Correlation Between Bitcoin and Dogecoin

Historically, there is a notable correlation between Bitcoin’s price and that of other cryptocurrencies like Dogecoin. Investors tend to view Bitcoin’s

performance as an indicator of the overall health of the crypto market, which can influence their decisions to buy or sell altcoins.

| Cryptocurrency | Correlation with Bitcoin |

|---|---|

| Dogecoin | High |

| Ethereum | Moderate |

| Litecoin | High |

Market Sentiment and Investor Behavior

The role of market sentiment is crucial when considering Bitcoin’s impact on Dogecoin. Positive sentiment around Bitcoin can enhance confidence in other cryptocurrencies,

potentially leading to a surge in their prices. Conversely, negative news about Bitcoin can trigger sell-offs across the board.

The Role of Social Media and Public Figures

Social media platforms and high-profile endorsements also play significant roles. For instance, when influential figures express views on Bitcoin,

it can create waves that also affect Dogecoin. The interconnected nature of these cryptocurrencies through social and investor behavior means

that changes in one can directly impact the other.

The dynamics between Bitcoin and Dogecoin are intricate and driven by multiple factors beyond simple market metrics. Exploring these relationships

requires looking into historical data, investor psychology, and external influences to understand their price movements better.

How Significant Is Social Media Influence on Dogecoin?

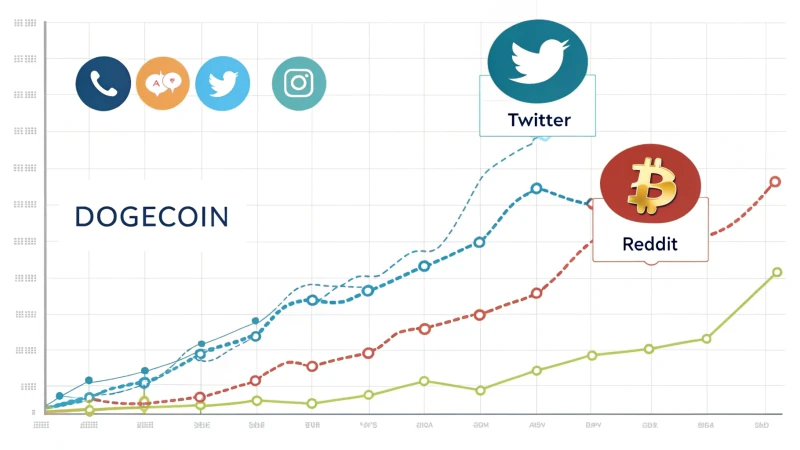

Social media has undeniably played a pivotal role in the volatile journey of Dogecoin. But how deeply does it influence the cryptocurrency’s market performance? Let’s explore.

Social media significantly impacts Dogecoin’s price by influencing investor sentiment and trading activity. High-profile endorsements and viral trends can trigger substantial price fluctuations, showcasing its sway over this meme-inspired cryptocurrency.

The Power of Viral Trends

Dogecoin’s journey is a testament to the power of viral trends. Initially launched as a meme-inspired joke, it gained mainstream attention thanks to communities on platforms like Reddit and Twitter. Social media amplified its popularity through memes, which led to a surge in its adoption within cryptocurrency communities.

| Platform | Role in Dogecoin’s Popularity |

|---|---|

| Community-driven discussions and campaigns | |

| Real-time news and celebrity endorsements |

Influential Figures and Market Impact

Elon Musk is perhaps the most famous example of an influential figure impacting Dogecoin’s market. His tweets often lead to immediate spikes in Dogecoin’s price, illustrating the significant influence of high-profile endorsements. The correlation between Musk’s tweets and Dogecoin’s price highlights how social media buzz can drive investor sentiment and spur trading activity.

Sentiment Analysis: A Double-Edged Sword

While social media can drive Dogecoin’s popularity, it also contributes to its volatility. Positive sentiment can inflate prices rapidly, but negative news can cause just as swift a decline. This duality poses risks for investors who may be swayed by short-term trends rather than underlying value. Analyzing sentiment trends on social media can offer insights but also requires caution.

Role of Social Media in Price Volatility

Dogecoin’s value is heavily influenced by speculative trading, often fueled by social media buzz. This speculation is both a blessing and a curse, as it can lead to quick profits but also significant losses. The unpredictability of social media trends adds another layer of complexity to trading decisions related to Dogecoin. It highlights the need for investors to remain vigilant about the sources they trust and the timing of their investments.

Community Engagement and Real-World Use Cases

The Dogecoin community is highly active on social platforms, driving initiatives like charitable donations and real-world merchant adoption. These grassroots efforts showcase the positive potential of social media engagement beyond mere speculation. Projects like these aim to enhance Dogecoin’s utility and stability over time, making it more than just a speculative asset.

In conclusion, while social media plays a crucial role in shaping Dogecoin’s narrative, its influence is multifaceted and should be approached with both optimism and caution.

What Are the Predictions for Dogecoin in 2025?

Curious about Dogecoin’s future? With its meme roots and volatile swings, the 2025 price predictions for Dogecoin are both exciting and uncertain. Here’s what experts say about its potential trajectory.

Dogecoin predictions for 2025 highlight potential growth influenced by market sentiment, technological adoption, and influential endorsements. While optimism exists, factors like volatility and regulatory changes play crucial roles in determining its future value.

Influencing Factors on Dogecoin’s 2025 Predictions

The cryptocurrency landscape is rife with fluctuations driven by multiple elements. To understand Dogecoin’s 2025 outlook, consider these factors:

| Factor | Impact |

|---|---|

| Market Sentiment | Influential in driving price; endorsement by figures like Elon Musk remains pivotal. |

| Technological Developments | Advancements could enhance utility and adoption. |

| Regulatory Changes | Potential to affect legality and usage. |

Technological Adoption and Merchant Use Cases

Increased adoption can substantially impact Dogecoin’s value. Merchants accepting DOGE add to its utility, providing real-world applications beyond speculation. If this trend continues, it could bolster confidence in the coin.

Market Dynamics and Speculation

Dogecoin’s past shows that speculation can swing prices dramatically. While some view this as a risk, others see it as an opportunity to benefit from quick gains. Understanding investor psychology is crucial when examining Dogecoin’s future.

Potential Price Resistance Levels

Despite optimistic predictions, analysts warn of potential resistance levels that could challenge sustained growth beyond $1. These hurdles might stem from both market conditions and technological bottlenecks. Monitoring these aspects is vital for accurate forecasting.

Endorsements and Social Media Influence

Social media remains a powerful tool in shaping public perception and sentiment around Dogecoin. High-profile endorsements can lead to significant price movements, reflecting the power of community support. Investing in such an environment requires attention to these ever-changing dynamics.

Long-term Projections and Expert Opinions

Experts have varied opinions on Dogecoin’s future value. While some predict surpassing $1, others caution against overreliance on short-term gains. Balancing optimism with market awareness is key to informed decision-making.

Which Factors Are Crucial for Dogecoin’s Price Growth?

Dogecoin’s price movement is influenced by a variety of factors, ranging from market sentiment to technological developments. Understanding these elements can provide insights into its potential future trajectory.

Dogecoin’s price growth is primarily driven by market dynamics, social media influence, and technological advancements. Market sentiment, notably influenced by figures like Elon Musk, plays a crucial role.

Market Dynamics and Influences

Dogecoin’s price is subject to the law of supply and demand. Increased merchant adoption and real-world applications can bolster its value. Additionally, economic conditions and regulatory changes are significant.

| Factor | Description |

|---|---|

| Supply & Demand | Influences overall availability and price fluctuations. |

| Regulations | Legal frameworks can either hinder or promote growth. |

Social Media and Celebrity Endorsements

Social media platforms like Twitter amplify Dogecoin’s reach. Notably, Elon Musk’s tweets often cause significant price movements. This influence is part of a broader trend where digital platforms shape market sentiment.

- Celebrity Influence: High-profile endorsements, especially from figures like Musk, drive interest and investment in Dogecoin.

- Viral Trends: Memes and viral challenges often correlate with short-term price spikes.

Technological Developments

Technological advancements within the cryptocurrency space can impact Dogecoin’s growth. Enhancements in blockchain technology may improve transaction efficiency and security, attracting more users.

- Blockchain Upgrades: Improvements can lead to increased adoption.

- Mining Efficiency: Innovations in mining technology can alter the supply dynamics, potentially affecting price.

Speculative Investments

As a meme-inspired cryptocurrency, Dogecoin experiences volatility due to speculative trading. Investor psychology and market trends heavily influence its price movements.

| Volatility Drivers | Examples |

|---|---|

| Speculation | Driven by investor sentiment and market trends. |

| Market Trends | Broader trends in cryptocurrency affect Dogecoin’s price. |

These factors collectively shape Dogecoin’s price trajectory, offering insights into its potential growth path without making definitive predictions. By understanding these elements, investors can make informed decisions regarding their engagement with this popular cryptocurrency.

How Does Market Volatility Affect Dogecoin?

Understanding the impact of market volatility on Dogecoin can help investors navigate its unpredictable price swings. Let’s delve into how these fluctuations influence Dogecoin’s value and investor sentiment.

Market volatility affects Dogecoin by causing rapid price fluctuations, driven by speculation and external factors like market sentiment and regulatory changes. These swings can lead to significant gains or losses for investors.

The Role of Speculation in Dogecoin’s Volatility

Dogecoin, often considered a meme cryptocurrency, is heavily influenced by speculation. This speculative nature leads to significant price volatility, where investor psychology and market trends dictate sudden price shifts. For instance, a tweet from a high-profile figure like Elon Musk can cause substantial changes in Dogecoin’s market value.

External Factors Influencing Volatility

Apart from speculation, external factors such as market sentiment and regulatory news can also trigger volatility in Dogecoin’s price. Positive sentiment or favorable news can lead to a surge in price, while negative developments can result in sharp declines.

Analyzing Past Trends

Analyzing historical data reveals patterns where Dogecoin’s price experienced spikes during periods of heightened market activity. This trend indicates that market dynamics and investor behavior significantly influence Dogecoin’s volatility.

| Period | Event Description | Price Impact |

|---|---|---|

| May 2021 | Social media hype and endorsements | Price surged 300% |

| September 2024 | Market correction | Price dropped 50% |

Investor Strategies Amidst Volatility

Investors often adopt various strategies to mitigate risks associated with Dogecoin’s volatility. Some choose short-term trading to capitalize on rapid price changes, while others prefer long-term holding, betting on future growth potential despite the current market fluctuations.

The Impact of Regulatory Changes

Regulatory announcements can significantly affect Dogecoin’s price stability. Any news regarding cryptocurrency regulations tends to create uncertainty, causing investors to react swiftly, thereby increasing volatility. Monitoring these changes is crucial for anyone involved in Dogecoin investments.

Understanding these aspects is essential for anyone looking to invest in or understand the dynamics of Dogecoin amidst a volatile market environment. By considering these factors, investors can better navigate the unpredictable nature of cryptocurrency markets.

Conclusion

Dogecoin’s potential to reach $1 by early 2025 hinges on market dynamics, Bitcoin’s influence, social media sentiment, and increased adoption amidst ongoing volatility and speculation.

- Discover why Bitcoin is considered a bellwether for the entire cryptocurrency market and its impact on altcoins.

- Explore how Bitcoin influences overall market sentiment and its cascading effects on other cryptocurrencies.

- Find historical data showing the correlation between Bitcoin and Dogecoin prices to understand their interconnected dynamics.

- Explore how Reddit has been a pivotal platform for Dogecoin’s viral growth and community-driven initiatives.

- Understand the direct correlation between Elon Musk’s tweets and significant price changes in Dogecoin.

- Gain insights into how social media sentiment influences Dogecoin’s market behavior.

- Learn about the risks and rewards of trading Dogecoin amid social media-driven speculation.

- Discover community-led initiatives that aim to increase Dogecoin’s real-world usage.

- Understanding price fluctuations helps anticipate market behavior, crucial for making informed investment decisions.

- Discover how increased merchant adoption can enhance Dogecoin’s real-world utility and value.

- Learn how social media plays a role in influencing cryptocurrency prices and investor sentiment.

- Discover how businesses accepting Dogecoin can enhance its value and potential growth.

- Explore how speculation drives cryptocurrency prices, including examples and analysis of its effects.

- Understand how market sentiment influences cryptocurrency values through case studies and expert insights.

- Discover effective strategies to manage risks and opportunities in volatile cryptocurrency markets.