Are you considering investing in cryptocurrency mining?

The Bitmain Antminer L9 stands out as one of the most profitable ASIC miners for Scrypt-based cryptocurrencies like Litecoin and Dogecoin. With a hashrate of 16.20 to 17.60 GH/s and lower power consumption, it offers impressive monthly earnings compared to its competitors.

In this post, we will explore the factors that contribute to the Antminer L9’s profitability and how it compares to other mining models in detail.

What is the Hashrate of the Antminer L9 Compared to Other Miners?

Discover how the Antminer L9’s hashrate compares to other mining rigs, and what that means for profitability in cryptocurrency mining.

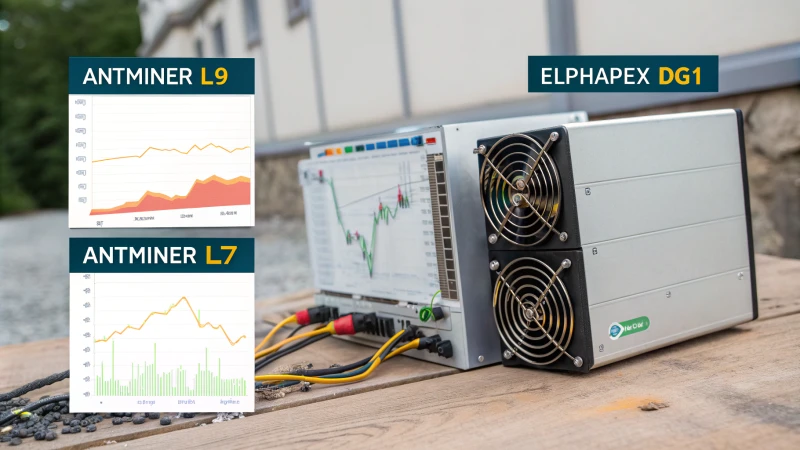

The Antminer L9 features a hashrate of approximately 16.20 to 17.60 GH/s, outperforming competitors like the Antminer L7 and Elphapex DG1 series in both efficiency and profitability.

Overview of the Antminer L9 Hashrate

The Bitmain Antminer L9 boasts an impressive hashrate of approximately 16.20 to 17.60 GH/s. This puts it at the forefront of ASIC miners designed for Scrypt-based cryptocurrencies.

When considering the performance of cryptocurrency miners, hashrate is a critical factor as it directly correlates with the potential earnings of a miner.

Comparison with Other Miners

Let’s break down how the Antminer L9 stacks up against its competitors:

| Bergarbeiter-Modell | Hashrate (GH/s) | Energieverbrauch (W) | Monthly Earnings ($) | Energy Efficiency (USD/W) |

|---|---|---|---|---|

| Antminer L9 | 16.20 – 17.60 | 3260 | $894.50 – $1,124.67 | 0.345 |

| Antminer L7 | 8.3 – 9.5 | 3425 | $546.36 – $607.06 | 0.159 – 0.177 |

| Elphapex DG1 | 11 – 14.4 | 3420 – 3950 | $702.92 | 0.205 – 0.233 |

| Elphapex DG1+ | 13-14 | 3950 | $920.18 | 0.233 |

As illustrated, the Antminer L9 not only outperforms the Antminer L7 in hashrate but also offers better energy efficiency compared to both Antminer L7 and Elphapex DG1 series miners.

Einblicke in die Rentabilität

The higher hashrate of the Antminer L9 translates to significantly greater potential monthly earnings, making it an attractive option for miners focused on profitability.

The performance of the Antminer L9 allows miners to optimize their operations effectively, especially during favorable market conditions, which can enhance their overall returns on investment.

Überlegungen zum Markt

It’s essential to keep in mind that the profitability of mining operations can fluctuate based on various factors, including cryptocurrency prices and electricity costs. Therefore, understanding how the Antminer L9 performs in comparison to its competitors can provide valuable insights into potential returns.

For those considering investing in mining hardware, examining the profitability of ASIC miners1 and current market trends2 can provide additional context to inform their decisions.

How Does Power Consumption Affect Mining Profitability?

Power consumption is a pivotal factor in determining mining profitability. Understanding its impact can help miners optimize their operations and maximize returns.

Power consumption affects mining profitability by influencing operational costs and energy efficiency of mining rigs, impacting overall earnings. Lower power consumption can lead to higher profit margins for miners.

Verständnis des Stromverbrauchs im Bergbau

Power consumption plays a crucial role in determining the profitability of cryptocurrency mining operations. Essentially, the more power a mining rig consumes, the higher the operational costs, which can significantly affect profit margins.

Mining rigs, such as the Antminer L9 and its competitors, showcase varying power consumption levels. For instance, the Antminer L9 consumes about 3260W, while other models like the Antminer L7 consume around 3425W. This difference in power consumption can lead to substantial variations in monthly earnings.

Analyse der Rentabilität

To illustrate how power consumption impacts profitability, we can analyze the monthly earnings based on current market conditions. Below is a comparative table of different mining rigs:

| Mining Rig | Hashrate (GH/s) | Energieverbrauch (W) | Monthly Earnings ($) | Energy Efficiency (USD/W) |

|---|---|---|---|---|

| Antminer L9 | 16.20 – 17.60 | 3260 | 894.50 – 1124.67 | 0.345 |

| Antminer L7 | 8.3 – 9.5 | 3425 | 546.36 – 607.06 | 0.159 – 0.177 |

| Elphapex DG1 | 11 – 14.4 | 3420 – 3950 | 702.92 | 0.205 – 0.233 |

| Elphapex DG1+ | – | 3950 | 920.18 | – |

This table shows that despite having lower power consumption, the Antminer L9’s superior hashrate leads to significantly higher monthly earnings compared to the other models.

Cost Analysis and Break-even Points

It’s essential to calculate break-even points considering both electricity costs and hardware expenses. For miners, understanding their power bills is critical since these costs can eat into profits.

For instance, if the electricity rate is $0.10 per kWh, the monthly electricity cost for the Antminer L9 would be:

- Monthly consumption = 3260W x 24 hours x 30 days = 2,358 kWh

- Monthly electricity cost = 2,358 kWh x $0.10/kWh = $235.80

This calculation highlights how power consumption directly impacts operational costs and subsequently, profit margins. Miners must regularly assess their energy efficiency and seek energy-saving solutions3 to maximize profitability.

Market Influences on Profitability

Market conditions also play a significant role in how power consumption affects mining profitability. Factors such as cryptocurrency prices and mining difficulty fluctuate, impacting earnings. Therefore, miners must stay informed about market trends to adjust their operations accordingly.

The higher the market price for mined cryptocurrencies, the more justifiable high power consumption becomes if it leads to greater returns. Conversely, during market downturns, miners may need to reevaluate their setups and possibly reduce energy consumption or switch to more efficient models.

In summary, managing power consumption is essential for optimizing profitability in cryptocurrency mining. By understanding how electricity usage influences costs and aligning operations with market conditions, miners can enhance their financial outcomes.

What Market Conditions Influence Mining Earnings for the Antminer L9?

Understanding market conditions is crucial for maximizing your mining profits with the Antminer L9. Here’s a look at the key factors that can influence your earnings.

Market conditions like cryptocurrency prices, mining difficulty, electricity costs, and regulatory trends significantly influence mining earnings with the Antminer L9. Staying informed about these factors is essential for optimizing profitability.

Preise für Kryptowährungen

The price of cryptocurrencies directly impacts mining earnings. When prices for Scrypt-based currencies like Litecoin (LTC) and Dogecoin (DOGE) rise, miners can expect higher returns from their operations. Conversely, a drop in prices can squeeze profitability. For example, if LTC trades at $100 versus $50, the potential monthly earnings from mining can vary significantly.

Schwierigkeit des Bergbaus

Another critical factor is the mining difficulty associated with these cryptocurrencies. Mining difficulty adjusts regularly based on the network’s total hashrate to ensure that blocks are mined at a consistent rate. A higher difficulty means that miners require more computational power, which can reduce overall earnings. Keep an eye on the difficulty trends4 to strategize effectively.

| Aspekt | High Difficulty | Low Difficulty |

|---|---|---|

| Mining Earnings | Lower due to competition | Higher as fewer miners compete |

| Required Hashrate | Increased | Decreased |

Elektrizitätskosten

Electricity is often the largest operational expense for miners. The Antminer L9 has a power consumption of approximately 3260W, making it vital to find competitive electricity rates. In areas where electricity costs are high, profitability may decrease sharply, making it crucial to calculate potential earnings against local rates.

Marktvolatilität

The cryptocurrency market is known for its volatility. Price fluctuations can occur rapidly and without warning, affecting both mining operations and market conditions. Miners should remain aware of this volatility and consider setting up alerts for significant price movements that may impact their earnings.

Future Trends and Regulations

Emerging regulations can also influence mining profitability. For instance, if legislation restricts mining operations in certain regions or increases taxation on crypto earnings, it can affect the overall appeal of mining investments like the Antminer L9. Keeping informed about regulatory changes5 in your area is essential for long-term planning.

By analyzing these market conditions—cryptocurrency prices, mining difficulty, electricity costs, market volatility, and regulatory trends—miners can make informed decisions that enhance their profitability with the Antminer L9 while navigating the complexities of the cryptocurrency landscape.

Are There Any Risks Associated with Investing in the Antminer L9?

Investing in the Antminer L9 may seem promising due to its high profitability, but it carries several risks that every potential investor should consider.

Investing in the Antminer L9 comes with risks including market volatility, rising energy costs, competition from other miners, regulatory changes, and maintenance needs that could impact profitability.

Market Volatility and Cryptocurrency Prices

Investing in the Antminer L9 involves exposure to the volatile cryptocurrency market. Prices of mined coins like Litecoin6 and Dogecoin can fluctuate dramatically, affecting profitability. For instance, if the price of Litecoin drops significantly, the returns from mining with the L9 will be adversely impacted.

Factors Affecting Cryptocurrency Prices:

- Market Sentiment: Investor sentiment can swing prices dramatically.

- Regulatory Changes: New regulations can create uncertainty, affecting prices.

- Technological Advancements: Improvements in mining technology can render existing miners less profitable.

Energy Costs and Efficiency

The Antminer L9 boasts impressive energy efficiency, yet rising electricity prices can erode profits. The device consumes approximately 3260W, leading to high monthly power bills.

| Parameter | Antminer L9 |

|---|---|

| Hashrate | 16.20 – 17.60 GH/s |

| Stromverbrauch | 3260W |

| Monthly Earnings | $894.50 – $1,124.67 |

As electricity costs rise, the operational costs associated with running the L9 can outweigh its profitability. Always consider your local electricity rates before investing.

Competition from Other Miners

The Antminer L9 is not the only player in the Scrypt mining space. Competitors like the Antminer L7 and Elphapex DG1 series may offer different performance metrics that could influence your investment decision.

| Bergarbeiter-Modell | Hashrate | Stromverbrauch | Monthly Earnings |

|---|---|---|---|

| Antminer L7 | 8.3 – 9.5 GH/s | 3425W | $546.36 – $607.06 |

| Elphapex DG1 | 11 – 14.4 GH/s | 3420 – 3950W | $702.92 – $920.18 |

While the L9 has advantages, other miners may offer lower entry costs or different efficiency levels that could impact your overall returns.

Regulatory Risks

Cryptocurrency mining is subject to varying regulations across different regions. These regulations can change quickly, impacting operational legality and costs.

- Tax Implications: Increased scrutiny on crypto earnings could lead to higher taxes for miners.

- Licensing Requirements: Some jurisdictions may require specific licenses for mining operations, adding to operational costs.

- Bans on Mining: Certain countries have implemented outright bans on crypto mining due to environmental concerns, which can affect investments significantly.

Maintenance and Operational Risks

The Antminer L9 requires ongoing maintenance to ensure optimal performance. Failing hardware components can lead to unexpected downtime and increased repair costs.

- Cooling Requirements: Proper cooling is essential to prevent overheating, necessitating additional investment in cooling systems.

- Downtime Costs: Any downtime directly affects your mining income, leading to potential losses during maintenance periods.

In summary, while the Antminer L9 presents an attractive investment opportunity in cryptocurrency mining, potential buyers should carefully consider these risks to make informed decisions about their investments.

How Does the Antminer L9 Compare in Energy Efficiency to Other Models?

Discover how the Antminer L9 stands out in energy efficiency compared to its competitors, and why it’s a smart choice for miners looking to optimize their operations.

The Antminer L9 offers superior energy efficiency at about 0.345 USD/W, outperforming models like the Antminer L7 and Elphapex DG1, making it an optimal choice for mining Scrypt-based cryptocurrencies.

Overview of the Antminer L9’s Energy Efficiency

The Antminer L9 is notable for its energy efficiency, rated at approximately 0.345 USD/W. This means that for every watt of electricity consumed, miners can expect to generate about 0.345 dollars in return. This metric positions the L9 as one of the most efficient mining rigs available for Scrypt-based cryptocurrencies like Litecoin and Dogecoin.

Comparison with Other Models

When comparing the Antminer L9 to other models, the following table highlights key metrics:

| Modell | Hashrate (GH/s) | Energieverbrauch (W) | Energy Efficiency (USD/W) | Monthly Earnings (USD) |

|---|---|---|---|---|

| Antminer L9 | 16.20 – 17.60 | 3260 | 0.345 | $894.50 – $1,124.67 |

| Antminer L7 | 8.3 – 9.5 | 3425 | 0.159 – 0.177 | $546.36 – $607.06 |

| Elphapex DG1 | 11 – 14.4 | 3420 – 3950 | 0.205 – 0.233 | $702.92 |

| Elphapex DG1+ | 11 – 14.4 | 3420 – 3950 | 0.205 – 0.233 | $920.18 |

As seen in the table, the L9’s energy efficiency significantly outperforms both the Antminer L7 and Elphapex DG1 models, making it a more attractive option for miners aiming to maximize profits while minimizing electricity costs.

Factors Influencing Energy Efficiency

Energy efficiency can vary due to several factors:

- Cryptocurrency Prices: Higher prices can increase profitability and justify higher power consumption.

- Mining Difficulty: Increased difficulty can lead to lower returns, impacting overall efficiency.

- Electricity Costs: Miners need to consider local electricity rates as they directly affect the profit margins.

By understanding these factors, miners can better assess how the Antminer L9 stacks up against competitors and whether it aligns with their operational goals.

Conclusion on Energy Efficiency Comparison

The comparison between the Antminer L9 and other models clearly shows that it leads in energy efficiency, making it a prime choice for those invested in Scrypt mining. For more insights on optimizing mining operations, consider exploring advanced strategies7 or cost-saving tips8.

Schlussfolgerung

The Antminer L9 excels in profitability with high hashrate and energy efficiency, outperforming rivals while being affected by market dynamics.

- Explore how different miners compare in terms of hashrate and efficiency to make informed decisions about your mining investments.

- Find out more about the profitability of ASIC miners to maximize your investment in cryptocurrency mining.

- Discover how energy efficiency can maximize your mining profits and reduce costs.

- This link provides insights into the impact of electricity costs on cryptocurrency mining profitability, which is crucial for your investment planning.

- Learn about market volatility and its effect on mining operations, helping you strategize better with your Antminer L9 investment.

- Explore this link to understand the latest market trends and how they might affect your investment in cryptocurrency mining.

- Explore detailed comparisons of energy efficiency in mining rigs to make informed decisions on your hardware investments.

- Find cost-saving strategies tailored for cryptocurrency miners to maximize profitability.