Der Dogecoin hat die Phantasie von Kryptowährungsfans auf der ganzen Welt angeregt und Debatten darüber ausgelöst, ob er die schwer fassbare 1-Dollar-Marke erreichen wird.

Dogecoin könnte bis Anfang 2025 $1 erreichen, angetrieben durch Aufwärtstrends, erhöhte Akzeptanz und Marktdynamik. Zu den wichtigsten Faktoren gehören die Entwicklung von Bitcoin, der Einfluss der sozialen Medien und die Stimmung der Anleger.

Der Weg des Dogecoin in Richtung 1 $ scheint vielversprechend zu sein, doch für Anleger ist es wichtig, die zugrunde liegenden Faktoren und Expertenprognosen zu verstehen. In diesem Blog befassen wir uns mit den Nuancen der Marktdynamik und den entscheidenden Elementen, die über den Weg des Dogecoin zu 1 $ entscheiden könnten.

Welche Rolle spielt Bitcoin bei der Dogecoin-Preisentwicklung?

Der Dogecoin-Kurs spiegelt oft die Bitcoin-Bewegungen wider und weckt die Neugier auf ihre Verbindung. Lassen Sie uns untersuchen, wie Bitcoin Dogecoin beeinflusst und welche Auswirkungen dies auf Investoren haben könnte.

Bitcoin dient oft als Marktführer und beeinflusst andere Kryptowährungen wie Dogecoin. Seine Kursbewegungen können Markttrends setzen, die Stimmung der Anleger beeinflussen und den Kurs von Dogecoin möglicherweise nach oben oder unten treiben.

Den Einfluss von Bitcoin auf Dogecoin verstehen

Bitcoin, der Pionier unter den Kryptowährungen, fungiert oft als Indikator für den gesamten Markt. Wenn Bitcoin signifikante Kursbewegungen erfährt, führt dies in der Regel zu einem Welleneffekt in der gesamten Kryptowährungssphäre.

Korrelation zwischen Bitcoin und Dogecoin

Historisch gesehen gibt es eine bemerkenswerte Korrelation zwischen dem Preis von Bitcoin und dem anderer Kryptowährungen wie Dogecoin. Investoren neigen dazu, die Bitcoin-Performance als Indikator für die allgemeine Gesundheit des Kryptomarktes zu betrachten, was ihre Entscheidungen zum Kauf oder Verkauf von Altcoins beeinflussen kann.

| Kryptowährung | Korrelation mit Bitcoin |

|---|---|

| Dogecoin | Hoch |

| Ethereum | Mäßig |

| Litecoin | Hoch |

Marktstimmung und Anlegerverhalten

Die Rolle der Marktstimmung ist entscheidend, wenn man die Auswirkungen von Bitcoin auf Dogecoin betrachtet. Eine positive Stimmung rund um Bitcoin kann das Vertrauen in andere Kryptowährungen stärken, was zu einem Anstieg ihrer Preise führen kann. Umgekehrt können negative Nachrichten über Bitcoin Ausverkäufe auf breiter Front auslösen.

Die Rolle der sozialen Medien und der Persönlichkeiten des öffentlichen Lebens

Soziale Medienplattformen und hochkarätige Befürwortungen spielen ebenfalls eine wichtige Rolle. Wenn sich beispielsweise einflussreiche Persönlichkeiten zu Bitcoin äußern, kann dies Wellen schlagen, die sich auch auf Dogecoin auswirken. Die Verflechtung dieser Kryptowährungen durch das Verhalten der Gesellschaft und der Anleger bedeutet, dass sich Veränderungen bei einer Währung direkt auf die andere auswirken können.

Die Dynamik zwischen Bitcoin und Dogecoin ist kompliziert und wird von mehreren Faktoren bestimmt, die über einfache Marktkennzahlen hinausgehen. Um diese Beziehungen zu erforschen, müssen historische Daten, die Psychologie der Anleger und externe Einflüsse untersucht werden, um die Preisbewegungen besser zu verstehen.

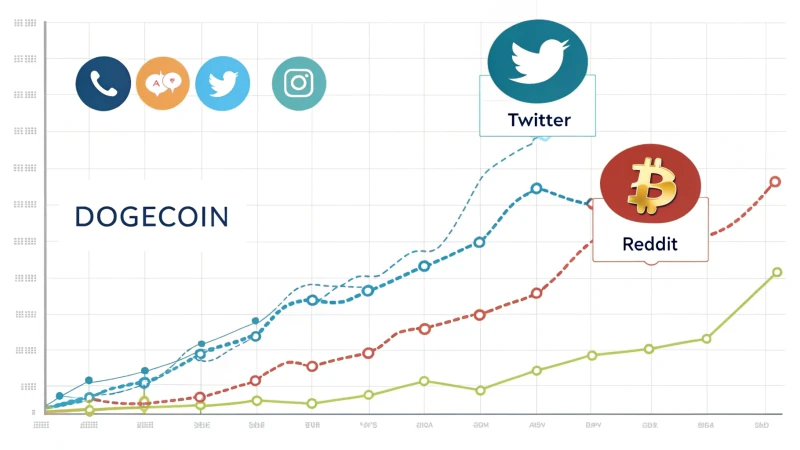

Wie groß ist der Einfluss der sozialen Medien auf Dogecoin?

Soziale Medien haben unbestreitbar eine zentrale Rolle bei der volatilen Entwicklung des Dogecoin gespielt. Aber wie stark beeinflussen sie die Marktentwicklung der Kryptowährung? Lassen Sie uns erkunden.

Soziale Medien haben einen erheblichen Einfluss auf den Dogecoin-Preis, indem sie die Stimmung der Anleger und die Handelsaktivitäten beeinflussen. Prominente Befürwortungen und virale Trends können beträchtliche Preisschwankungen auslösen und zeigen, welchen Einfluss sie auf diese von Memes inspirierte Kryptowährung haben.

Die Macht der viralen Trends

Der Weg des Dogecoin ist ein Beweis für die Macht der viralen Trends. Ursprünglich als von einem Meme inspirierter Scherz gestartet, erlangte er dank Communities auf Plattformen wie Reddit und Twitter Aufmerksamkeit im Mainstream. Soziale Medien verstärkten seine Popularität durch Memes, was zu einem Anstieg seiner Akzeptanz innerhalb der Kryptowährungsgemeinschaften führte.

| Platform | Rolle bei der Popularität von Dogecoin |

|---|---|

| Von der Gemeinschaft gesteuerte Diskussionen und Kampagnen | |

| Echtzeit-Nachrichten und Prominentenempfehlungen |

Einflussreiche Persönlichkeiten und Auswirkungen auf den Markt

Elon Musk ist vielleicht das berühmteste Beispiel für eine einflussreiche Persönlichkeit, die den Dogecoin-Markt beeinflusst. Seine Tweets führen oft zu einem sofortigen Anstieg des Dogecoin-Kurses, was den bedeutenden Einfluss prominenter Befürworter verdeutlicht. Die Korrelation zwischen Musks Tweets und dem Dogecoin-Kurs verdeutlicht, wie die Begeisterung in den sozialen Medien die Stimmung unter den Anlegern beeinflussen und die Handelsaktivität anregen kann.

Stimmungsanalyse: Ein zweischneidiges Schwert

Soziale Medien können zwar die Popularität des Dogecoin steigern, tragen aber auch zu seiner Volatilität bei. Positive Stimmungen können die Preise schnell in die Höhe treiben, aber negative Nachrichten können ebenso schnell einen Rückgang verursachen. Diese Dualität birgt Risiken für Anleger, die sich eher von kurzfristigen Trends als vom zugrunde liegenden Wert leiten lassen. Die Analyse von Stimmungstrends in sozialen Medien kann Aufschluss geben, erfordert aber auch Vorsicht.

Die Rolle der sozialen Medien bei der Preisvolatilität

Der Wert des Dogecoin wird stark vom spekulativen Handel beeinflusst, der oft durch den Hype in den sozialen Medien angeheizt wird. Diese Spekulation ist sowohl ein Segen als auch ein Fluch, da sie zu schnellen Gewinnen, aber auch zu erheblichen Verlusten führen kann. Die Unvorhersehbarkeit der Trends in den sozialen Medien macht Handelsentscheidungen in Bezug auf Dogecoin noch komplexer. Es unterstreicht die Notwendigkeit für Investoren, wachsam zu bleiben, was die Quellen, denen sie vertrauen, und den Zeitpunkt ihrer Investitionen angeht.

Engagement der Gemeinschaft und reale Anwendungsfälle

Die Dogecoin-Gemeinschaft ist auf sozialen Plattformen sehr aktiv und treibt Initiativen wie Spenden für wohltätige Zwecke und die Akzeptanz bei realen Händlern voran. Diese Graswurzelbemühungen zeigen das positive Potenzial des Engagements in den sozialen Medien, das über reine Spekulationen hinausgeht. Projekte wie diese zielen darauf ab, den Nutzen und die Stabilität des Dogecoin im Laufe der Zeit zu verbessern und ihn zu mehr als nur einer spekulativen Anlage zu machen.

Zusammenfassend lässt sich sagen, dass die sozialen Medien zwar eine entscheidende Rolle bei der Gestaltung der Dogecoin-Geschichte spielen, ihr Einfluss jedoch vielschichtig ist und sowohl mit Optimismus als auch mit Vorsicht genossen werden sollte.

Was sind die Prognosen für Dogecoin im Jahr 2025?

Neugierig auf die Zukunft von Dogecoin? Mit seinen Meme-Wurzeln und volatilen Schwankungen sind die Preisvorhersagen für Dogecoin für 2025 sowohl spannend als auch unsicher. Hier ist, was Experten über seine potenzielle Flugbahn sagen.

Die Dogecoin-Prognosen für 2025 heben das potenzielle Wachstum hervor, das von der Marktstimmung, der technologischen Akzeptanz und einflussreichen Befürwortern beeinflusst wird. Obwohl Optimismus besteht, spielen Faktoren wie Volatilität und regulatorische Änderungen eine entscheidende Rolle bei der Bestimmung des zukünftigen Wertes.

Einflussfaktoren auf die Dogecoin-Prognosen für 2025

Die Kryptowährungslandschaft ist voller Fluktuationen, die durch verschiedene Faktoren bedingt sind. Um die Aussichten von Dogecoin für 2025 zu verstehen, sollten Sie diese Faktoren berücksichtigen:

| Faktor | Auswirkungen |

|---|---|

| Marktstimmung | Einfluss auf den Preis; die Unterstützung durch Persönlichkeiten wie Elon Musk ist nach wie vor von entscheidender Bedeutung. |

| Technologische Entwicklungen | Weiterentwicklungen könnten den Nutzen und die Akzeptanz erhöhen. |

| Regulatorische Änderungen | Mögliche Auswirkungen auf Rechtmäßigkeit und Verwendung. |

Technologieübernahme und Anwendungsfälle für Händler

Eine zunehmende Akzeptanz kann den Wert von Dogecoin erheblich beeinflussen. Händler, die DOGE akzeptieren, erhöhen seinen Nutzen und bieten reale Anwendungen jenseits der Spekulation. Wenn dieser Trend anhält, könnte dies das Vertrauen in den Coin stärken.

Marktdynamik und Spekulation

Die Vergangenheit von Dogecoin zeigt, dass Spekulationen die Preise dramatisch beeinflussen können. Während einige dies als Risiko betrachten, sehen andere es als eine Gelegenheit, von schnellen Gewinnen zu profitieren. Das Verständnis der Anlegerpsychologie ist entscheidend, wenn es um die Zukunft von Dogecoin geht.

Potenzielle Preis-Widerstandsniveaus

Trotz optimistischer Prognosen warnen Analysten vor potenziellen Widerständen, die ein nachhaltiges Wachstum über 1 $ hinaus in Frage stellen könnten. Diese Hürden könnten sowohl auf die Marktbedingungen als auch auf technologische Engpässe zurückzuführen sein. Die Überwachung dieser Aspekte ist für eine genaue Vorhersage unerlässlich.

Befürwortungen und Einfluss auf soziale Medien

Soziale Medien sind nach wie vor ein mächtiges Instrument, um die öffentliche Wahrnehmung und die Stimmung rund um Dogecoin zu beeinflussen. Prominente Befürwortungen können zu signifikanten Kursbewegungen führen, was die Macht der Unterstützung durch die Community widerspiegelt. In einem solchen Umfeld zu investieren, erfordert Aufmerksamkeit für diese sich ständig verändernde Dynamik.

Langfristige Projektionen und Expertenmeinungen

Experten haben unterschiedliche Meinungen über den zukünftigen Wert von Dogecoin. Während einige vorhersagen, dass der Wert 1 $ übersteigen wird, warnen andere davor, sich zu sehr auf kurzfristige Gewinne zu verlassen. Ein Gleichgewicht zwischen Optimismus und Marktkenntnis ist der Schlüssel zu einer fundierten Entscheidungsfindung.

Welche Faktoren sind ausschlaggebend für das Preiswachstum von Dogecoin?

Die Kursentwicklung des Dogecoin wird von einer Vielzahl von Faktoren beeinflusst, die von der Marktstimmung bis zu technologischen Entwicklungen reichen. Das Verständnis dieser Elemente kann Einblicke in seine mögliche zukünftige Entwicklung geben.

Das Preiswachstum von Dogecoin wird in erster Linie von der Marktdynamik, dem Einfluss der sozialen Medien und technologischen Fortschritten bestimmt. Die Marktstimmung, die vor allem von Persönlichkeiten wie Elon Musk beeinflusst wird, spielt eine entscheidende Rolle.

Marktdynamik und -einflüsse

Der Preis von Dogecoin unterliegt dem Gesetz von Angebot und Nachfrage. Die zunehmende Akzeptanz durch Händler und reale Anwendungen können seinen Wert steigern. Darüber hinaus sind die wirtschaftlichen Bedingungen und regulatorische Änderungen von Bedeutung.

| Faktor | Beschreibung |

|---|---|

| Angebot und Nachfrage | Beeinflusst die allgemeine Verfügbarkeit und Preisschwankungen. |

| Verordnungen | Rechtliche Rahmenbedingungen können das Wachstum entweder behindern oder fördern. |

Soziale Medien und Prominente als Werbeträger

Soziale Medienplattformen wie Twitter verstärken die Reichweite von Dogecoin. Vor allem die Tweets von Elon Musk führen oft zu erheblichen Kursbewegungen. Dieser Einfluss ist Teil eines breiteren Trends, bei dem digitale Plattformen die Marktstimmung beeinflussen.

- Einfluss von Prominenten: Prominente Befürwortungen, insbesondere von Persönlichkeiten wie Musk, steigern das Interesse und die Investitionen in Dogecoin.

- Virale Trends: Memes und virale Herausforderungen korrelieren oft mit kurzfristigen Preisspitzen.

Technologische Entwicklungen

Technologische Fortschritte im Bereich der Kryptowährungen können das Wachstum von Dogecoin beeinflussen. Verbesserungen in der Blockchain-Technologie können die Transaktionseffizienz und -sicherheit verbessern und mehr Nutzer anziehen.

- Blockchain-Upgrades: Verbesserungen können zu einer erhöhten Akzeptanz führen.

- Effizienz im Bergbau: Innovationen in der Bergbautechnologie können die Angebotsdynamik verändern, was sich auf den Preis auswirken kann.

Spekulative Investitionen

Als Meme-inspirierte Kryptowährung ist der Dogecoin aufgrund des spekulativen Handels volatil. Die Psychologie der Anleger und die Markttrends haben einen großen Einfluss auf seine Preisbewegungen.

| Treiber der Volatilität | Beispiele |

|---|---|

| Spekulationen | Getrieben von der Stimmung der Anleger und den Markttrends. |

| Markttrends | Breitere Trends bei Kryptowährungen beeinflussen den Dogecoin-Preis. |

Diese Faktoren prägen gemeinsam den Kursverlauf des Dogecoin und bieten Einblicke in seinen potenziellen Wachstumspfad, ohne endgültige Vorhersagen zu machen. Durch das Verständnis dieser Elemente können Anleger fundierte Entscheidungen über ihr Engagement in dieser beliebten Kryptowährung treffen.

Wie wirkt sich die Marktvolatilität auf den Dogecoin aus?

Das Verständnis der Auswirkungen der Marktvolatilität auf den Dogecoin kann Anlegern helfen, die unvorhersehbaren Preisschwankungen zu bewältigen. Lassen Sie uns herausfinden, wie diese Schwankungen den Wert des Dogecoin und die Stimmung der Anleger beeinflussen.

Die Marktvolatilität wirkt sich auf den Dogecoin aus, indem sie zu schnellen Kursschwankungen führt, die durch Spekulationen und externe Faktoren wie die Marktstimmung und regulatorische Änderungen verursacht werden. Diese Schwankungen können zu erheblichen Gewinnen oder Verlusten für Anleger führen.

Die Rolle der Spekulation bei der Volatilität von Dogecoin

Der Dogecoin, der oft als Meme-Kryptowährung betrachtet wird, wird stark von Spekulationen beeinflusst. Diese spekulative Natur führt zu einer erheblichen Preisvolatilität, bei der die Psychologie der Anleger und Markttrends plötzliche Preisveränderungen diktieren. Zum Beispiel kann ein Tweet von einer hochkarätigen Persönlichkeit wie Elon Musk erhebliche Veränderungen im Marktwert von Dogecoin verursachen.

Externe Faktoren, die die Volatilität beeinflussen

Abgesehen von Spekulationen können auch externe Faktoren wie die Marktstimmung und regulatorische Nachrichten die Volatilität des Dogecoin-Kurses auslösen. Eine positive Stimmung oder günstige Nachrichten können zu einem Preisanstieg führen, während negative Entwicklungen zu starken Kursverlusten führen können.

Analyse der vergangenen Trends

Die Analyse historischer Daten zeigt Muster, bei denen der Dogecoin-Kurs in Zeiten erhöhter Marktaktivität in die Höhe schoss. Dieser Trend deutet darauf hin, dass die Marktdynamik und das Anlegerverhalten die Volatilität von Dogecoin erheblich beeinflussen.

| Zeitraum | Ereignis Beschreibung | Preisauswirkungen |

|---|---|---|

| Mai 2021 | Hype in den sozialen Medien und Befürwortungen | Preisanstieg von 300% |

| September 2024 | Marktkorrektur | Preis gesunken 50% |

Anlagestrategien inmitten der Volatilität

Anleger wenden oft verschiedene Strategien an, um die mit der Volatilität von Dogecoin verbundenen Risiken zu mindern. Einige entscheiden sich für den kurzfristigen Handel, um von den schnellen Preisänderungen zu profitieren, während andere eine langfristige Haltung bevorzugen und trotz der aktuellen Marktschwankungen auf das zukünftige Wachstumspotenzial setzen.

Die Auswirkungen der regulatorischen Änderungen

Ankündigungen von Regulierungsbehörden können die Preisstabilität von Dogecoin erheblich beeinflussen. Jede Nachricht über die Regulierung von Kryptowährungen führt in der Regel zu Unsicherheiten, auf die die Anleger schnell reagieren und so die Volatilität erhöhen. Die Überwachung dieser Änderungen ist für jeden, der in Dogecoin-Investitionen involviert ist, entscheidend.

Das Verständnis dieser Aspekte ist für jeden, der in einem volatilen Marktumfeld in Dogecoin investieren oder die Dynamik von Dogecoin verstehen möchte, unerlässlich. Durch die Berücksichtigung dieser Faktoren können Anleger besser durch die unvorhersehbare Natur der Kryptowährungsmärkte navigieren.

Schlussfolgerung

Das Potenzial von Dogecoin, bis Anfang 2025 1 Dollar zu erreichen, hängt von der Marktdynamik, dem Einfluss von Bitcoin, der Stimmung in den sozialen Medien und der zunehmenden Akzeptanz inmitten der anhaltenden Volatilität und Spekulationen ab.

- Erfahren Sie, warum Bitcoin als Indikator für den gesamten Kryptowährungsmarkt gilt und welchen Einfluss er auf Altcoins hat.

- Erforschen Sie, wie Bitcoin die allgemeine Marktstimmung beeinflusst und welche Auswirkungen dies auf andere Kryptowährungen hat.

- Finden Sie historische Daten, die die Korrelation zwischen Bitcoin- und Dogecoin-Kursen aufzeigen, um ihre miteinander verbundene Dynamik zu verstehen.

- Erfahren Sie, wie Reddit eine entscheidende Plattform für das virale Wachstum von Dogecoin und die von der Gemeinschaft getragenen Initiativen war.

- Verstehen Sie die direkte Korrelation zwischen den Tweets von Elon Musk und den signifikanten Preisänderungen des Dogecoin.

- Gewinnen Sie Erkenntnisse darüber, wie die Stimmung in den sozialen Medien das Marktverhalten von Dogecoin beeinflusst.

- Erfahren Sie mehr über die Risiken und Vorteile des Dogecoin-Handels inmitten von Spekulationen in den sozialen Medien.

- Entdecken Sie von der Gemeinschaft geführte Initiativen, die darauf abzielen, die reale Nutzung von Dogecoin zu erhöhen.

- Das Verständnis von Kursschwankungen hilft, das Marktverhalten zu antizipieren, was für fundierte Anlageentscheidungen von entscheidender Bedeutung ist.

- Entdecken Sie, wie eine erhöhte Händlerakzeptanz den realen Nutzen und Wert von Dogecoin steigern kann.

- Erfahren Sie, wie soziale Medien die Preise von Kryptowährungen und die Stimmung der Anleger beeinflussen.

- Entdecken Sie, wie Unternehmen, die Dogecoin akzeptieren, dessen Wert und Wachstumspotenzial steigern können.

- Erforschen Sie, wie Spekulation die Preise von Kryptowährungen antreibt, einschließlich Beispielen und Analysen ihrer Auswirkungen.

- Verstehen Sie anhand von Fallstudien und Expertenwissen, wie die Marktstimmung den Wert von Kryptowährungen beeinflusst.

- Entdecken Sie effektive Strategien, um Risiken und Chancen auf den volatilen Kryptowährungsmärkten zu managen.