Introduction

In the vast and ever-evolving world of cryptocurrencies, Bitcoin stands as the pioneering force, much like the eldest child in a family. Its price fluctuations, often unpredictable and swift, can be likened to the fleeting emotions of a young child. Just as a child clings to the waning days of summer, savoring every last drop of sunshine and freedom, Bitcoin’s value sometimes seems to be trying to hold onto its peaks, reluctant to let go.

Chasing the Last Rays of Summer

The end of summer vacation is a poignant time for many children. It’s a period filled with a mix of excitement for the upcoming school year and a longing to extend the carefree days of summer just a bit longer. This sentiment mirrors the behavior of Bitcoin’s price. When it reaches a high, there’s a collective hope among investors and enthusiasts that it will sustain, or even climb further. Yet, the inherent volatility of the crypto market means that these highs can be short-lived, much like the fleeting days of summer for a child.

Current Bitcoin Price Analysis

In the ever-fluctuating world of digital currency, Bitcoin remains the beacon that many turn their eyes to. As of now, its price dances just a shade above the $26,000 threshold, a figure that might ring a bell for those with a keen eye on the crypto market.

Echoes of Early Summer

For seasoned investors and crypto enthusiasts alike, this current valuation might feel like a trip down memory lane. It’s reminiscent of the early summer vibes when Bitcoin was basking in similar price ranges. The market, much like nature, has its cycles, and Bitcoin seems to be retracing its steps back to those warmer days.

Recent Historical Events

In the intricate tapestry of Bitcoin’s journey, certain events stand out, painting a vivid picture of its ever-evolving nature. The past few weeks have been particularly noteworthy, with significant shifts in the crypto landscape.

Scaling New Heights: Difficulty Adjustment

A mere fortnight ago, the Bitcoin network experienced a pivotal moment. The difficulty adjustment, a mechanism intrinsic to the functioning of the blockchain, soared to unprecedented levels. This all-time high not only showcased the increasing competition among miners but also underscored the resilience and adaptability of the network.

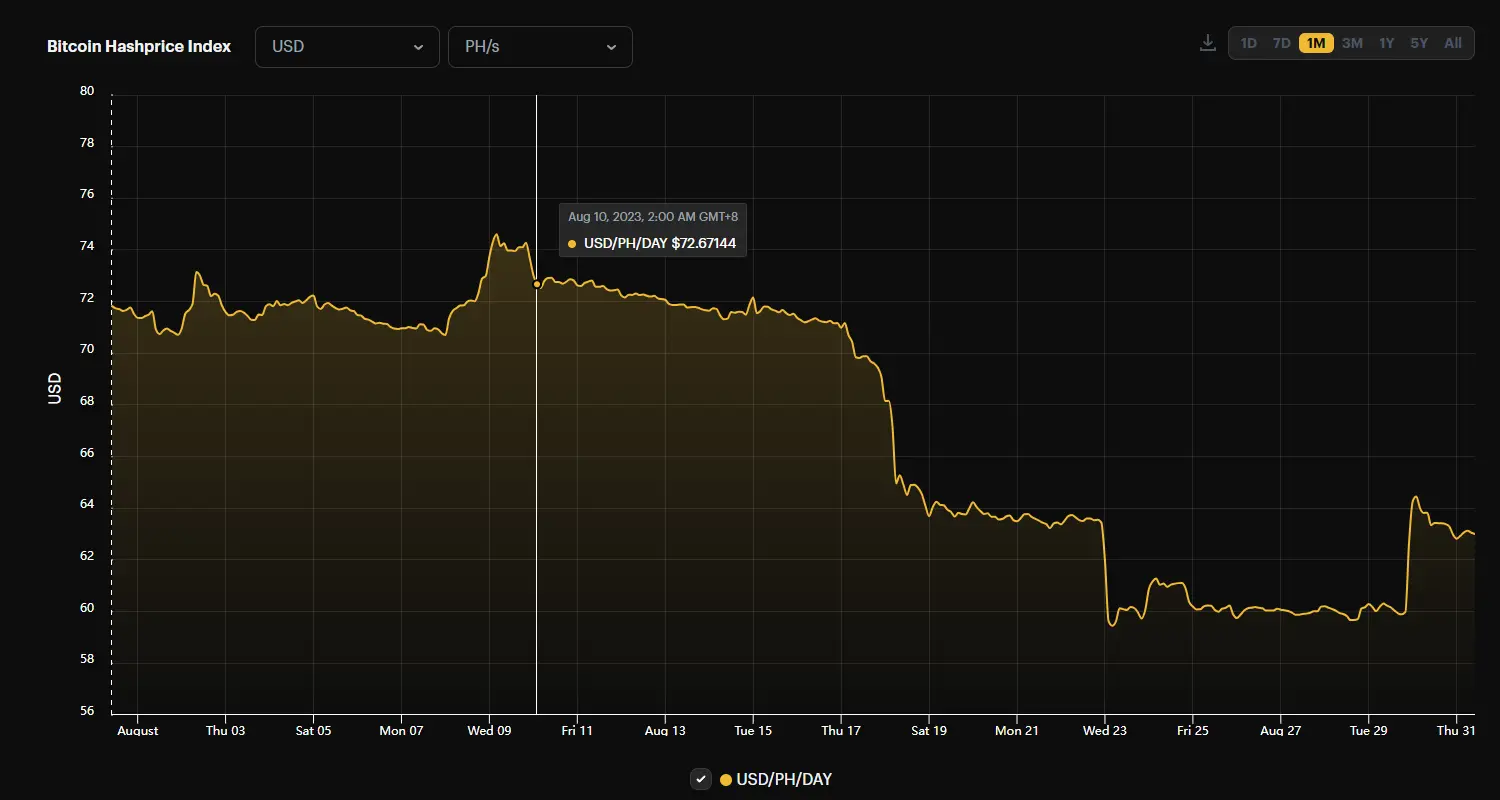

The Hashrate Plunge: A New Low

In the wake of this peak, another significant event unfolded. The hashrate price, a critical metric determining the computational power of the Bitcoin network, took a surprising dip. Falling momentarily beneath the $60/PH/day mark, it settled at a new record low of $59/PH/day. This shift, while momentary, highlighted the volatile nature of the crypto ecosystem and the constant interplay of various factors influencing it.

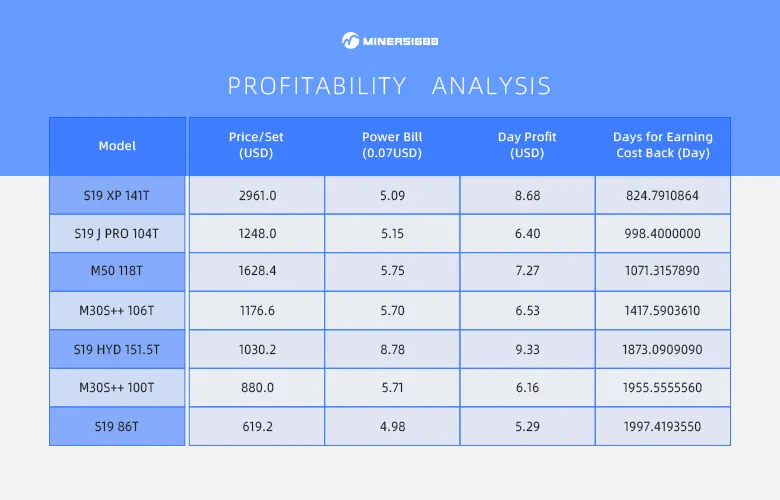

Profitability Analysis for Popular Mining Models

The world of cryptocurrency mining is a complex interplay of hardware efficiency, electricity costs, and market dynamics. With the current hashrate price setting the stage, and electricity costs pegged at a competitive $0.07/kWh, it’s crucial for miners to understand the potential returns on their investments. Let’s delve into the daily profitability of some of the most sought-after mining models in the industry.

The Mining Elite: Top Performers

Antminer S19 XP: Leading the pack with a commendable daily return, the S19 XP boasts a profit of $3.4. Its efficiency and power make it a favorite among seasoned miners.

M50S+: Not far behind, the M50S+ showcases its prowess with a daily yield of $2.7. Its balance of performance and energy consumption has garnered significant attention.

Mid-Range Marvels: Consistent Contenders

S19j Pro: A staple in many mining operations, the S19j Pro offers a consistent return of $1.1/day, making it a reliable choice for those looking for steady gains.

M30S++: With a daily profit margin of $0.90, the M30S++ stands as a testament to the blend of affordability and performance.

The Steady Players: Value for Money

S19 & M30S+: Both these models, each yielding $0.30/day, represent the more economical end of the spectrum. They are ideal for newcomers or those looking to expand their operations without breaking the bank.

Future Predictions

The cryptocurrency realm, with its intricate algorithms and volatile market dynamics, is always on the move. As we stand on the cusp of significant shifts, it’s essential to forecast the potential turns the Bitcoin journey might take in the near future.

The Halving Horizon: April 2024

With the much-anticipated halving event slated for April 2024, there’s a palpable tension in the air. Current profit margins, when juxtaposed against this upcoming event, seem to be treading on thin ice. Miners and investors alike might need to brace for a period of discomfort as the rewards for mining are slashed in half.

The Silver Lining: A Potential Ease in Mining Difficulty

Every cloud has a silver lining, and in the world of Bitcoin mining, this might manifest as a decrease in mining difficulty. As the hashrate scales new peaks, the subsequent period could witness a more lenient mining environment, offering a brief respite to the mining community.

The Epoch’s Tale: A Fluctuating Forecast

The current epoch’s progress stands at a noteworthy 34%. With projections indicating a hashrate drop of approximately 4.76%, the mining landscape seems poised for change. However, the crypto winds are fickle. The next week and a half could usher in significant shifts, contingent on the unpredictable ebbs and flows of the hashrate.

Bitcoin Mining Market Data Update

In the pulsating heart of the cryptocurrency world, Bitcoin’s hashrate serves as a vital pulse check. The past weeks have witnessed a rollercoaster of events, with the 7-day average hashrate painting a story of triumphs followed by challenges.

Scaling the Summit: A Record-Breaking Hashrate

On August 17th, the Bitcoin community had reason to celebrate. The 7-day average hashrate touched a monumental 417EH/s, etching a new chapter in its historical ledger. This peak showcased the collective computational power and commitment of miners globally.

From Zenith to Nadir: The 7% Descent

However, the jubilation was short-lived. In a swift turn of events, the hashrate plummeted to 388EH/s, marking a significant 7% decrease. Such fluctuations are not uncommon but always pique interest regarding the underlying causes.

Deciphering the Drop: Unraveling the Causes

Several factors might have contributed to this decline:

- Economic Pressures: The recent squeeze in hashrate prices compelled high-cost miners to power down their machines, opting for a wait-and-watch approach in hopes of more favorable conditions.

- Nature’s Wrath: Mother Nature played her part too. The preceding week saw Texas grappling with extreme heatwaves, causing disruptions in its power grid. This climatic challenge prompted major mining conglomerates to scale back, prioritizing electricity conservation over mining operations.

Weekly Highlights

In the ever-evolving tapestry of the cryptocurrency domain, certain events stand out, casting ripples that affect various facets of the market. This week was no exception, with the crypto community abuzz with anticipation and consequential market shifts.

Ordinal Maxi Biz Series 1 Inscription

The spotlight this week was firmly on the impending launch of the Ordinal Maxi Biz Series 1 inscription. This event, much awaited by enthusiasts and investors alike, promised not just a new product but also hinted at potential market dynamics shifts. The crypto world watched with bated breath, eager to decipher the impact of this launch on the broader ecosystem.

The Domino Effect: Surge in Transaction Fees

As with many significant events in the crypto space, the launch had a domino effect. One of the most palpable repercussions was the noticeable uptick in transaction fees. While correlation doesn’t always imply causation, the timing of the fee surge post the Ordinal Maxi Biz Series 1 announcement was hard to overlook. It served as a reminder of the intricate interdependencies within the crypto market.